With the first half of 2025 in the rearview, there’s no shortage of crosscurrents affecting real estate and investment strategy right now. Here’s a quick rundown of what’s shaping the landscape—on Capitol Hill, in the markets, and around the globe.

1. Washington’s Latest Magic Trick: Trillions Disappearing on Paper

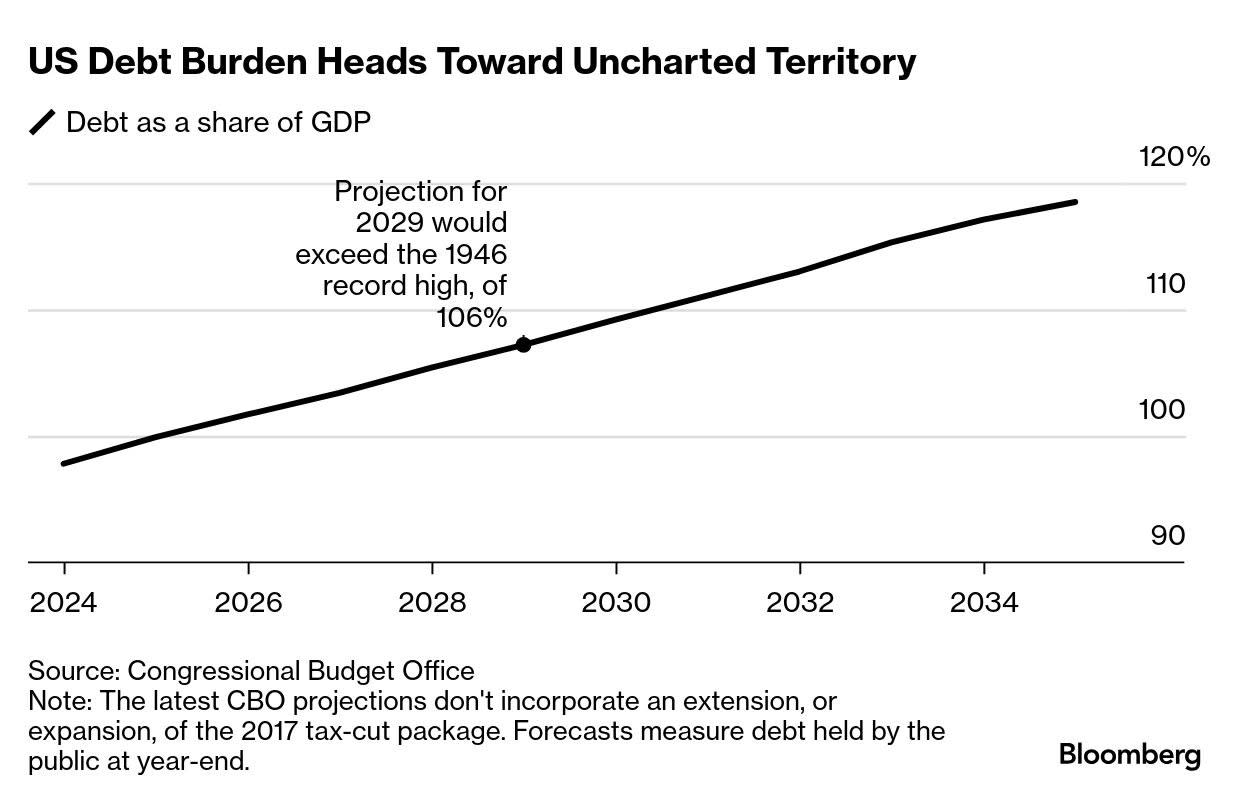

Senate Republicans are pushing to permanently extend the 2017 Trump-era tax cuts—without technically adding $3.8 trillion to the deficit. How? A never-before-used parliamentary maneuver designed to sweep the costs off the books. If this sleight of hand sticks, it sets a new precedent: Congress can pass massive tax cuts, avoid budget caps, and call it “neutral.”

The bill also doubles down on business tax breaks, while scaling back some of Trump’s earlier populist gestures like tax relief on tips and overtime. Expect this to heighten political scrutiny of corporate tax planning, particularly in sectors with strong lobbying arms like real estate and energy.

Wall Street’s response? Shrug. The Nasdaq 100 hit a fresh record on the same day. Markets see through the debt optics—but don’t seem to mind, at least not yet.

2. Consumer Confidence Drops, Housing Cools

The Conference Board’s consumer confidence index fell to 93 in June—a signal that Main Street is uneasy. That anxiety is showing up in housing: national home price appreciation slowed to 2.7% year-over-year in April, down from 3.4% the month before. It’s the weakest pace since mid-2023.

In practical terms: higher borrowing costs, cooling sentiment, and election-year uncertainty are starting to freeze decision-making among homebuyers. Sellers are either holding out or dropping price. Developers should expect longer lease-ups and more conservative appraisals over the back half of the year.

3. The AI Arms Race—and China’s Move to the Front

China is positioning itself for a tech-driven leap forward. Former PBOC deputy Zhu Min says the country could generate over 100 AI breakthroughs like DeepSeek in the next 18 months. With GDP growth forecast at 4.5%, AI and high-tech sectors are expected to account for more than 18% of GDP by 2026.

Whether you’re watching data centers, semiconductor supply chains, or office demand in global tech hubs—this matters. The next bull run in CRE could be driven by infrastructure that supports AI, not people.

4. Microsoft Cuts Thousands—Wall Street Cheers

Microsoft’s layoffs continue, with another round targeting Xbox and sales teams. That’s on top of 6,000+ job cuts earlier this year. Investors rewarded the move—shares jumped almost 1%.

We’re in an era where tech companies are shedding headcount, not adding it. That translates to less office absorption and weaker urban demand in legacy tech corridors like San Francisco, Seattle, and Austin. At the same time, it creates tailwinds for industrial and data center growth.

5. Heat Waves Trigger Power Emergencies

The Southeast is sweating—literally. A federal emergency order is letting utilities like Duke Energy exceed pollution limits just to keep the lights on. PJM, which covers 13 states, is seeing power usage near a 14-year high.

That’s not just a climate headline—it’s a real estate one. Strained grids affect project feasibility, capex planning, and ESG compliance. In places like Texas and the Carolinas, utility capacity is becoming a gating item on new development.

Bottom Line:

We’re operating in a world where fiscal rules are being rewritten, confidence is cooling, AI is ascending, and climate strain is hitting infrastructure. None of this is theoretical. It’s showing up in appraisals, deal timelines, investor behavior, and rent rolls.

Keep your eyes wide, your models agile, and your capital stack defensive.

More to come.

—Daniel