Let’s talk about the most unlikely casualty of the tariff war: your favorite oversized water bottle.

No, seriously. If you’ve been on TikTok (or have a teenage daughter), you know that Stanley’s 40-ounce Quencher Flowstate Tumbler is more than a cup—it’s a cultural moment. But here’s the problem: that viral “big dumb cup” is about to get hit with a not-so-dumb 145% tariff thanks to our growing trade war with China. And Stanley isn’t alone. Yeti’s drinkware line, beloved by campers and suburbanites alike, may be just as exposed.

I’ve been combing through trade data—yes, that’s what passes for a good time in my world—and I noticed something interesting. There’s one product category that we import almost exclusively from China: “vacuum flasks and other vacuum vessels… other than glass inners.” Catchy name, right?

Translation: tumblers, thermoses, and travel mugs.

In 2024, the U.S. imported more than $1.6 billion worth of these vessels. China supplied 96% of it. That’s a near-monopoly. And when you consider that Stanley’s flagship product is entirely dependent on this supply chain, the implications start to look serious.

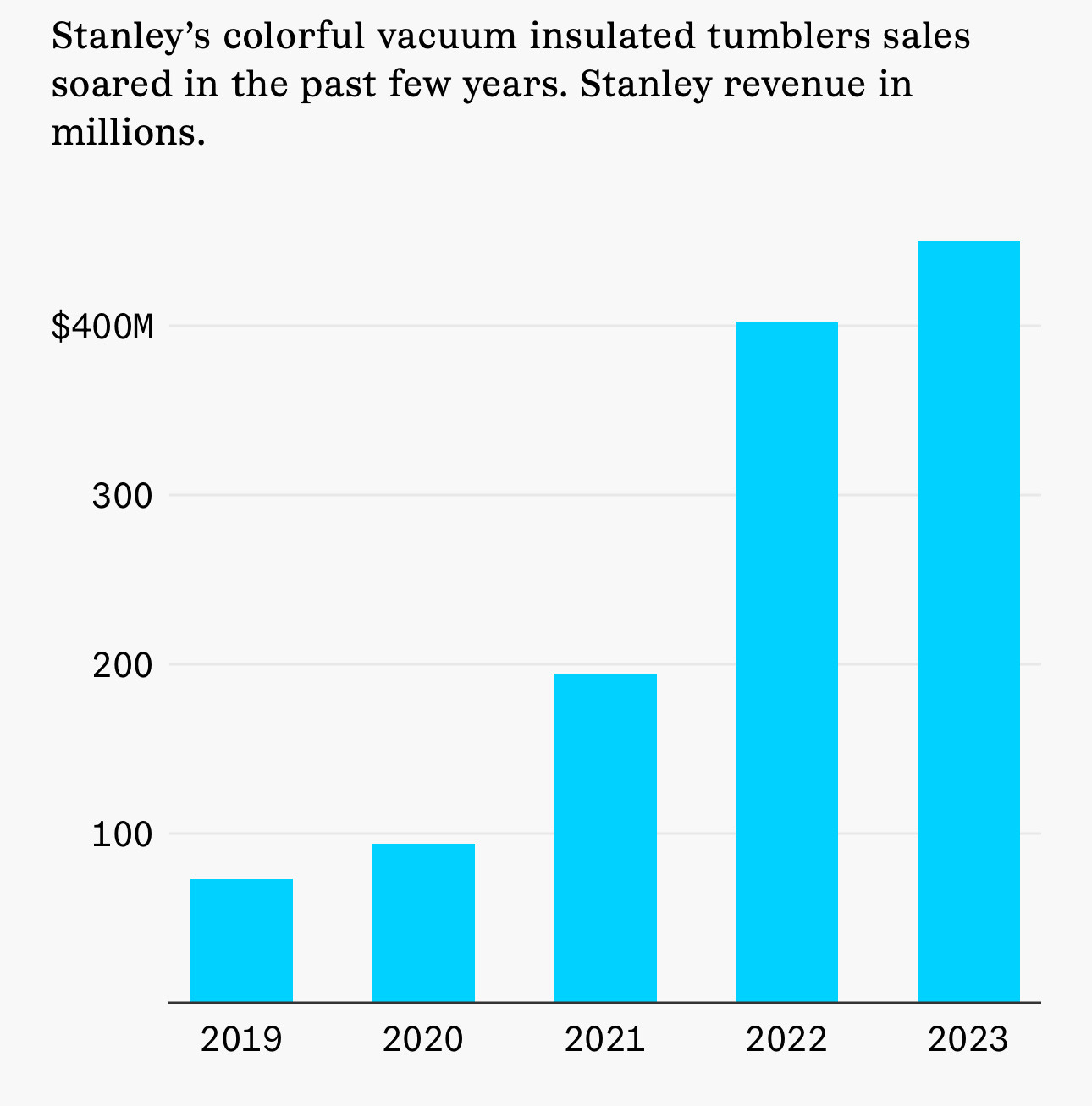

Stanley’s rise has been meteoric. Back in 2019, the brand brought in $73 million in revenue. By 2023? $750 million. A tenfold jump fueled by influencer marketing, pastel color drops, and a brand revival that even landed them in an SNL skit. Today, they’ve got a rabid fanbase, a loyalty program, and a product that sells out faster than Beyoncé tickets.

But here’s where the tariff pain kicks in.

Stanley’s tumblers are primarily made in China. If the new 145% tariff goes into effect, that $45 Flowstate Tumbler could end up retailing for over $110. Even die-hard collectors might find that hard to swallow.

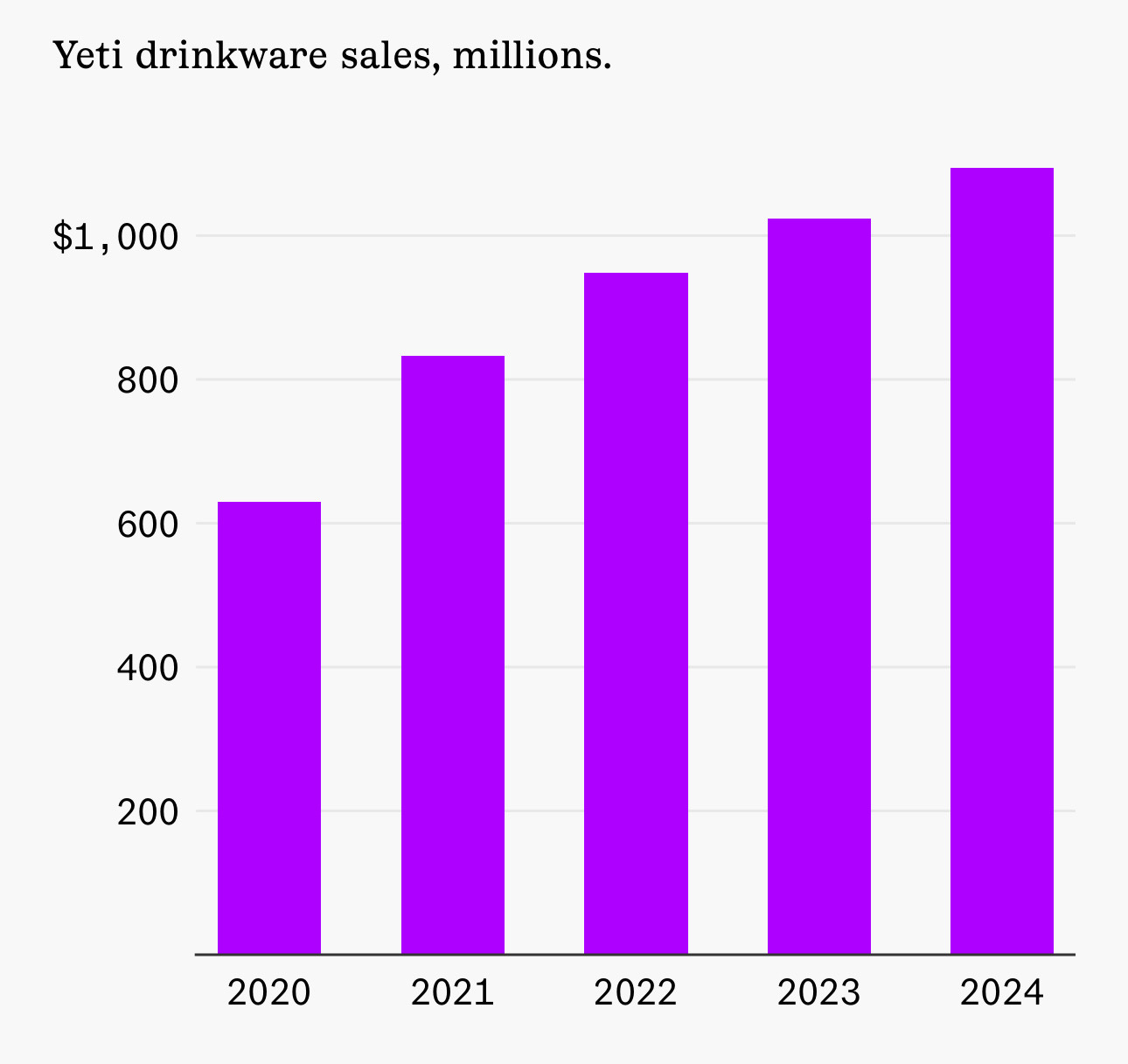

Yeti’s in a similar boat. The company pulled in $1.83 billion in 2024 revenue, and over $1 billion of that came from its drinkware. The company doesn’t own its own factories—it relies on just two manufacturers for 74% of production, and most of the product arrives on U.S. shores from—you guessed it—China.

They’ve already warned investors: steep tariffs could erode margins or force price hikes. Either option spells trouble.

To put a finer point on it, Yeti’s $65 Rambler water bottle might jump to $159 if the full tariff burden is passed through.

These aren’t just feel-good lifestyle brands. They’re profitable businesses with massive consumer bases. And if tariffs knock the wind out of their sails, that ripple will be felt across supply chains, retailers, and secondary manufacturers.

For investors, this is a reminder that trade policy isn’t just about steel and semiconductors—it’s about everyday goods, brand equity, and pricing power. It’s about how a $45 tumbler became a $110 tariff grenade. And it’s about how companies dependent on single-source global supply chains may find themselves tumbling into oblivion—fast.

Daniel Kaufman

President, Kaufman Development

Subscribe for more real estate and investment insights: danielkaufmanre.substack.com