The Florida dream is unraveling—and fast. In the past six months, thousands of condo owners across the state have quietly joined a mass exodus, rushing to unload units before the math gets worse. The narrative we’ve been tracking—rising insurance costs, tighter financing, regulatory pressure—is no longer just noise. It’s a full-blown signal. A market that once felt untouchable is showing structural cracks. And investors would be wise to pay attention.

The Numbers Don’t Lie

Let’s start here: Over 1,400 condo buildings in Florida are now blacklisted by Fannie Mae. That means buyers can’t get agency-backed loans to purchase units in these buildings, making already-soft demand even more anemic. For developers and real estate professionals, this should trigger sirens. We’re witnessing a liquidity crisis in slow motion.

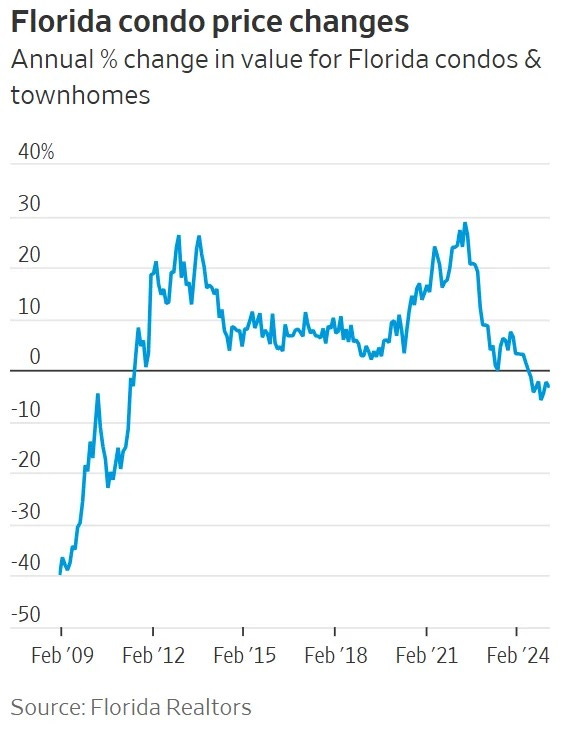

Older condos—particularly those built before 1995—are getting decimated. ISG World reports that prices on 30+ year-old buildings have dropped 22% over the last two years. That’s not a correction. That’s a collapse.

What’s Fueling the Fire

Three converging forces are driving this:

-

Insurance Chaos – Premiums have doubled or tripled in many parts of the state, especially post-Ian and Idalia. Carriers are pulling out. HOAs are passing the pain onto owners.

-

Regulatory Fallout – Post-Surfside, Florida passed tough inspection and reserve requirements. The problem? Less than 25% of buildings are compliant. Special assessments are crushing owners—some north of $10,000 per unit.

-

Financing Freeze – Lenders are hitting pause on buildings undergoing major repairs or flagged for risk. One misfiled form can put a building on the blacklist, halting deals midstream.

A Market Turning on Itself

I’m hearing the same story again and again. Owners are trying to sell, just to get out. Developers are walking away from older assets or reassessing condo conversion strategies altogether. Brokers are struggling to comp deals, as values swing wildly between “motivated seller” and “don’t bother.”

Rob and Karen Dickson’s experience is all too common. They bought a golf-course-view condo for $319K in 2021, then sold it in 2023 for less than they paid—after eating a $7,200 assessment and skyrocketing HOA fees. They left Florida entirely. This isn’t anecdotal—it’s becoming the norm.

Why This Should Worry Every Florida Investor

Florida is home to 20% of the nation’s condos. More than half are over 30 years old. The financial and structural fragility of this asset class is now posing systemic risks. And here’s the kicker: for the first time in recent history, Florida is beginning to lose population.

That data point should stop every multifamily and BTR investor in their tracks.

We’ve built our post-COVID investment thesis on the back of inbound migration. But insurance shocks, affordability concerns, and now crumbling condo infrastructure? They’re pushing people out. And when the narrative breaks, the capital follows.

Legislative Lifelines or Too Little, Too Late?

Yes, the state is scrambling. Governor DeSantis is pushing for a delay in reserve mandates. New bills propose leniency for buildings in transition. But none of that rewrites the math on aging assets, deferred maintenance, or population shifts.

Some owners will hold. Many more will sell. And the best-prepared investors will be the ones who’ve already adjusted their lens on Florida.

Final Thought

If you’ve been waiting for confirmation that the Florida real estate market is teetering—this is it. The condo crisis isn’t an isolated event. It’s the leading edge of a broader shift in sentiment, capital, and strategy.

We’ve seen this movie before—just not in a place with hurricanes, 30-year-old plumbing, and a population that’s starting to pack up.

Daniel Kaufman is President of Kaufman Development and writes frequently on real estate trends at the intersection of policy, capital, and strategy. Read more at www.danielkaufmanre.com.