And what it tells us about supply, demand, and what’s coming next

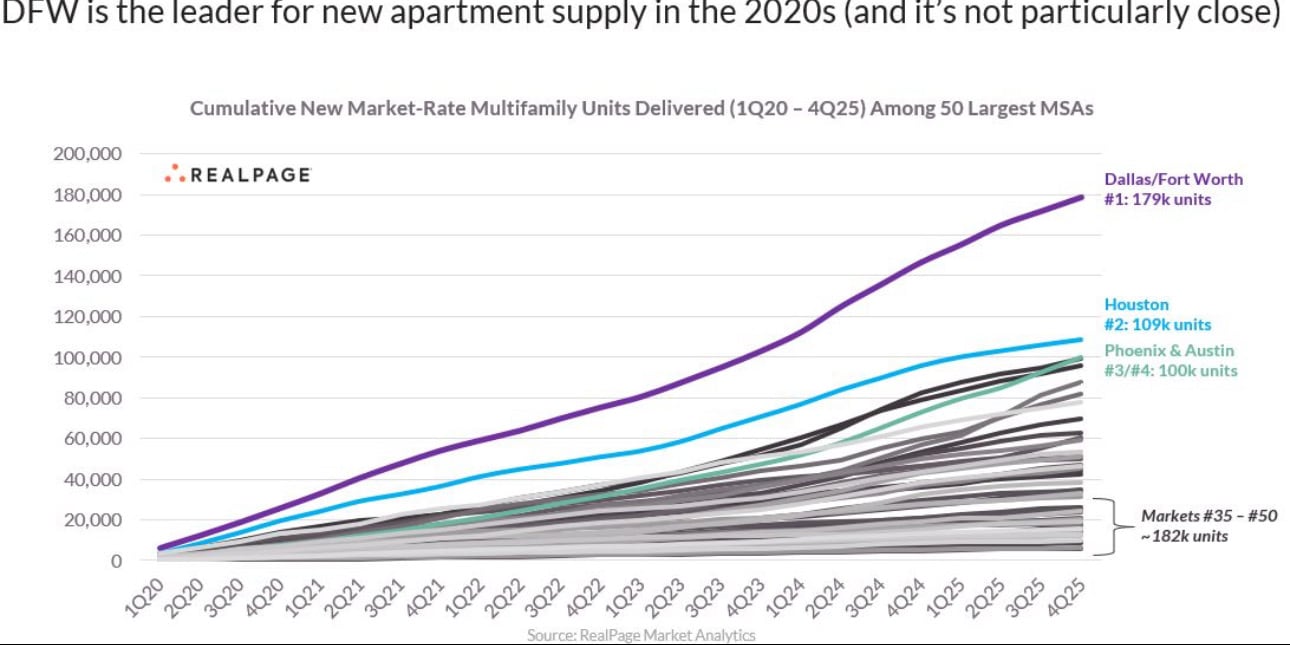

Let’s start with the headline: If everything currently in the pipeline delivers on time, DFW will have added nearly 180,000 new multifamily units between 2020 and the end of 2025. That puts it far ahead of every other U.S. metro.

Houston comes in second with 109,000 units—a big number on its own, but it looks modest next to DFW’s surge. And here’s the thing: only DFW and Houston even crack the six-figure mark during this stretch. The rest of the country isn’t playing the same game.

Now for the real jaw-dropper:

It took DFW 18 years—from 2000 through early 2019—to add the same number of units it’s now adding in just six. That’s not just growth; that’s velocity. And it speaks volumes about where developers are betting long-term.

Another fun stat: Since 2020, DFW has delivered more new apartments than the combined total of every metro ranked #35 through #50—that includes places like Oakland, Kansas City, Columbus, and Memphis. Even if you throw out a few of the smaller markets, it’s still a wild comparison.

A Few More Supply Trends Worth Watching:

✅ Austin just missed the top three for total supply, falling behind Phoenix by only 500 units. But Austin leads the country in relative growth, expanding its total housing stock by a staggering 40% since 2020. Charlotte (37%) and Nashville (33%) round out the top three.

✅ Phoenix has been a late bloomer. It didn’t break into the top five until mid-2023—but now, nearly half of its new units through 2025 are coming online just in 2024 and 2025. The last two years of this cycle will match what Phoenix built in the first four.

✅ And then there’s New York and San Francisco—two metros with the lowest cumulative supply growth since 2020: just 4.6% and 5.0% respectively. Yet they rank #1 and #3 nationally for year-over-year rent growth. It’s a clear reminder of what happens when demand sticks around but supply doesn’t.

Why It Matters

DFW isn’t just leading the country in apartment construction—it’s defining what this next cycle of growth looks like. The sheer volume of new supply raises key questions around absorption, pricing power, and investor appetite going forward.

But it also reinforces something we talk about a lot here: when demand is strong, the markets that build win. And when you constrain supply, well… rents tend to take care of themselves.

More soon,

–Daniel