After two years of frozen activity, parts of the commercial real estate market are starting to move again—but don’t mistake momentum for stability.

Yes, deal volume is climbing. Yes, there’s renewed interest across segments. But look just beneath the surface, and a very different reality emerges: stress is building, maturities are accelerating, and capital remains selective.

This is a rebound with caveats. And for developers, lenders, and LPs, now is the time to look past the headline figures and focus on what’s really driving this market.

📊 The Volume Rebound Is Real—But Incomplete

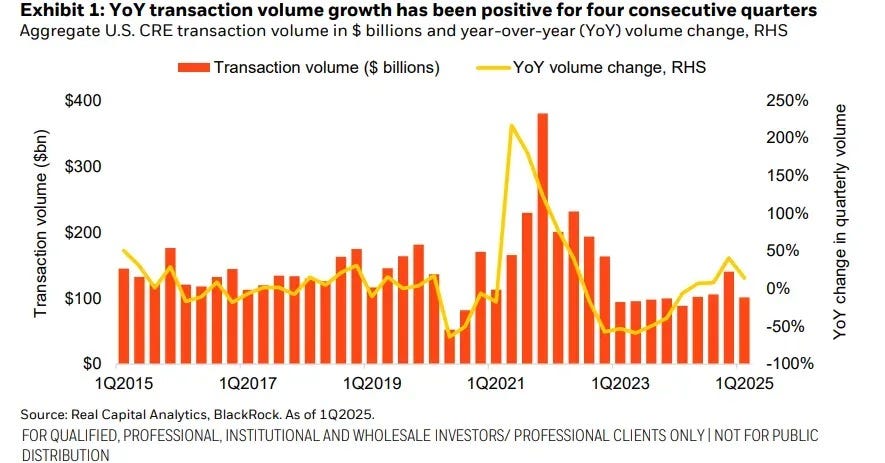

CRE transaction volume rose 14% year-over-year in Q1 2025, and April alone saw $26 billion in deals. That’s four straight quarters of growth—a welcome trend after a near-frozen 2022.

But volumes are still well below pre-pandemic norms, and the recovery is highly uneven. Industrial, data centers, and selective multifamily trades are moving. But office remains in crisis mode, and even retail is navigating a sharp bifurcation between necessity-based and discretionary tenanting.

💸 Why Deal Flow Is Up: Higher Rates, New Mentality

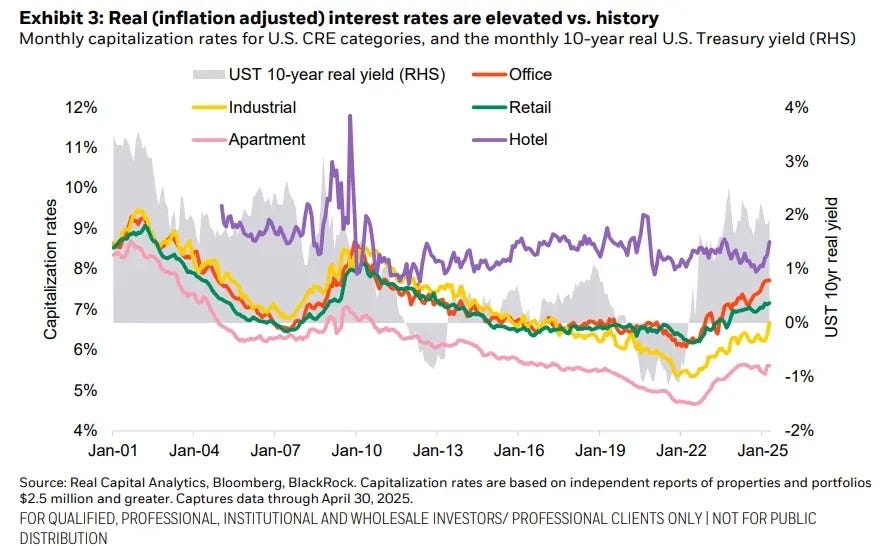

What’s fueling this activity? Ironically, it’s the growing acceptance that rates aren’t coming back down anytime soon. The market has adjusted to structurally higher borrowing costs.

Investors are no longer waiting for a rate pivot—they’re pricing deals based on income durability, not exit cap rate compression. In short, we’re in an era where cash flow matters again.

That said, with nominal rates above 5% and real (inflation-adjusted) yields still punitive, acquisition financing remains a challenge. Equity buyers with a long view are stepping in where traditional debt is constrained.

🚨 Distress Is Building, Fast

Distressed CRE climbed to $116 billion in Q1—up 31% from a year earlier. Office leads the pack, but stress is bleeding into other asset classes too.

More telling is the type of workout activity underway: 62% of CMBS resolutions are now maturity extensions. These aren’t true refinancings—they’re lifelines. And 68% of those extensions are tied to office properties, where fundamentals continue to erode.

⏳ The $625 Billion Maturity Wall

Here’s the real pressure point: $625 billion in CRE loans are set to mature in 2025, on top of $520 billion that was already kicked down the road last year.

Banks—who hold nearly half of those loans—remain open to workouts, but that flexibility has limits. As rate expectations shift and regulators grow more hawkish, more of those “extend-and-pretend” strategies may reach their expiration date.

Don’t let modest growth in deal volume fool you—this is not a rising tide lifting all boats. It’s a selective, bifurcated recovery, where risk is compressing into underperforming assets and capital is chasing fewer, better opportunities.

For developers and investors, that means two things:

-

Pick your spots carefully.

-

Capitalize on distress—if you have the liquidity and timing to act.

We’re entering a market where strategy matters more than ever. The headlines may look better, but under the hood, we’re still deep in the reset.