Los Angeles Developer | Founder, Kaufman Development

There are headlines that feel like metaphors, and then there’s this: Apple just chartered cargo planes to fly 1.5 million iPhones—600 tons worth—from India to the U.S. It’s the most literal flex I’ve seen from a company trying to outmaneuver a policy trap.

What’s the trap? Tariffs. And while Apple has the cash and coordination to fly over the problem, the rest of us—investors, operators, developers—have to navigate through it.

This Isn’t Just a Tech Story

Yes, the tech sector took a hit this week. The S&P 500 dropped 3.5%, the Nasdaq tumbled 4.2%, and small caps got hammered, with the Russell 2000 down 4.3%. Every S&P sector finished in the red except for consumer staples. Energy? Down 6.5%. Tech? Not far behind.

But this isn’t just a tech meltdown—it’s a market-wide gut check on policy uncertainty, global exposure, and what happens when two economic superpowers escalate with zero predictability.

“Good Luck Planning Anything Right Now”

I was asked recently how tariffs affect real estate, and my answer was simple: if volatility is the virus, real estate is the immune system trying to compensate.

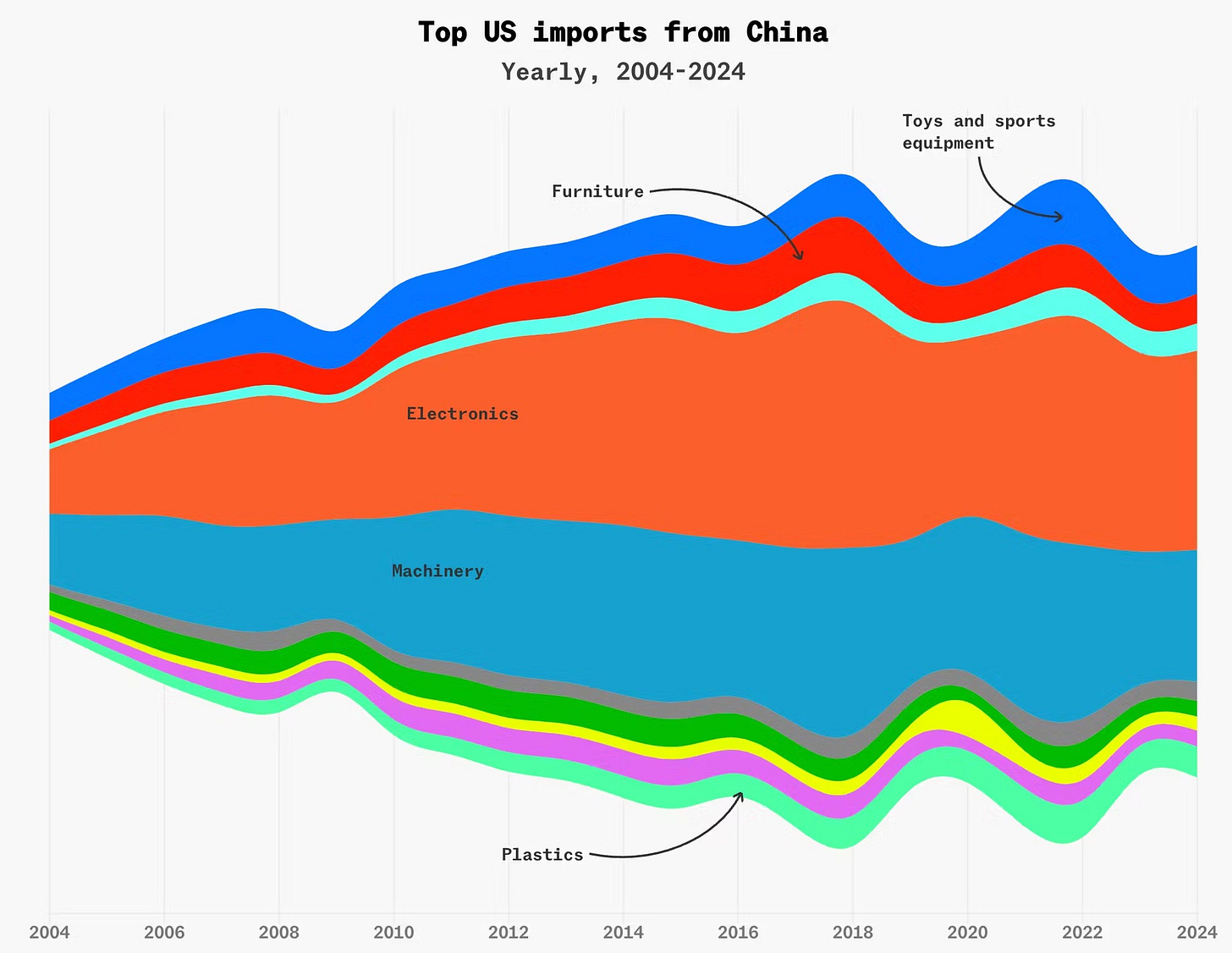

The U.S. and China are in an open trade war. Tariffs on Chinese imports just jumped to 145%. China responded by more than doubling its own tariffs on U.S. goods. That’s not brinksmanship—that’s active fire.

If you’re a CEO trying to plan supply chains, or a developer trying to model construction costs six months out, you might as well flip a coin. And it’s not just big corporations—this filters all the way down to materials pricing, labor availability, shipping logistics, and investor sentiment.

“We’re in an environment where you can’t predict next quarter, let alone the next cycle,” I said during a recent investor call. “And that’s where the opportunity lies—if you’re patient and pragmatic.”

When All Correlations Go to One

We’re in earnings season. But if you’re expecting clarity from the quarterly numbers, don’t hold your breath. Typically, during this period, stocks start to trade more on individual performance than macro noise. This time, it’s the reverse.

The question on every earnings call: How are tariffs impacting your outlook?

Walmart pulled its Q1 guidance. Delta yanked its full-year forecast. Constellation Brands couldn’t even say what part of its supply chain was subject to tariffs—just the cans? The beer? Both?

Even semiconductors, which were supposedly “spared,” are trading like the other shoe’s about to drop.

In a normal market, we price stocks independently. In a volatile one, they move together. And right now? Everything is correlated. That’s a recession signal. Or at least, a loud knock on the door.

What’s the Real Estate Angle?

For developers and investors, this volatility is fuel and friction at the same time. If you’re building, you’re looking at longer lead times, wider bids, and unpredictable material costs. If you’re buying, underwriting risk premiums just got trickier. If you’re sitting on cash, this is where it gets interesting.

We’ve seen this before—uncertainty narrows the field. The disciplined get deals. The reactive get wrecked.

“Markets punish indecision,” I reminded a partner this week. “But they reward clarity of thesis, even in chaos.”

So here’s the thesis: Stay nimble. Watch pricing trends. Don’t buy into the noise, but don’t ignore the signals. And for the love of your LPs—don’t underwrite Q2 like it’s Q1.

Want more of this straight to your inbox?

Subscribe for weekly investor-minded commentary on development, strategy, and what’s next in real estate and the economy.