Markets may be catching their breath, but business leaders sure aren’t.

As President Trump ramps up his latest round of tariffs—this time zeroing in on chips and high-tech imports from China—C.E.O. confidence has quietly dropped to its lowest level since spring 2020. Let that sink in. We’re back to early-pandemic levels of uncertainty… and that’s saying something.

Despite a modest rally overseas and some early morning green in the Nasdaq, the underlying story is anything but calm. There’s deep confusion in boardrooms right now about what’s actually happening with trade policy. Trump says no one’s getting off the hook. But just days ago, his own administration spared a swath of electronics from the worst of it—only for him to post on Truth Social:

“NOBODY is getting ‘off the hook,’ especially not China which, by far, treats us the worst!”

The mixed messages are triggering déjà vu for anyone who lived through the last tariff war. But this time, the stakes are higher—and the supply chain fragility is more exposed than ever. Companies are trying to recalibrate pricing models, reassess investment timelines, and rethink where they’re sourcing parts, products, and labor.

Why does this matter for us?

Because when capital expenditures slow and multinational strategy gets cloudy, real estate becomes one of the few places capital can still find clarity.

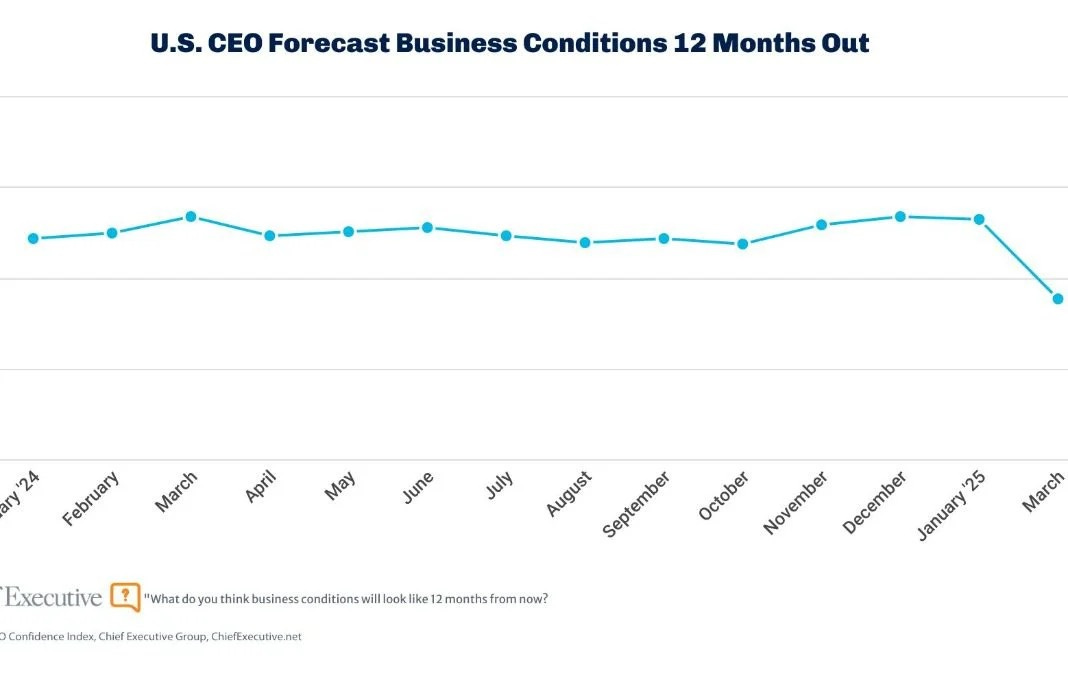

Let’s zoom out. Here’s what the latest Chief Executive magazine poll tells us:

-

76% of CEOs say the tariffs are actively hurting their business.

-

Only 26% plan to increase capital spending, down from 37% just last quarter.

-

62% are forecasting a recession or slowdown in the next six months.

That means less corporate expansion, fewer large-scale industrial plays, and more hesitancy from tenants in office, logistics, and high-tech R&D facilities. It also means more demand for leaner, nimbler real estate strategies—think modular, workforce, and build-to-rent communities that can flex with economic tides.

“Although I am in support of moving more manufacturing back to the U.S., this is not how to do it.”

— Peter Ensch, CEO of Sani-Matic

He’s not wrong. Real reshoring requires stable policy, long-term vision, and serious investment in housing and infrastructure—not headline-chasing economic warfare.

So what’s the move for developers and investors?

Stay agile. Look for cracks in the system that create opportunities—distressed corporate landholdings, stalled industrial builds, and communities seeing sudden job growth from reshoring without the housing to support it.

This trade chaos is more than just a geopolitical chess match. It’s a signal. And for those of us building the next decade of housing and placemaking, it’s time to pay close attention.

Daniel Kaufman is the founder of Kaufman Development and Oldivai. He writes about capital, construction, and where housing fits into the big economic picture.

More at danielkaufmanre.com and dkaufmandevelopment.com