After months of uncertainty, U.S. consumer confidence is finally showing signs of life—and the timing couldn’t be better for those of us watching capital markets and real estate sentiment with a close eye.

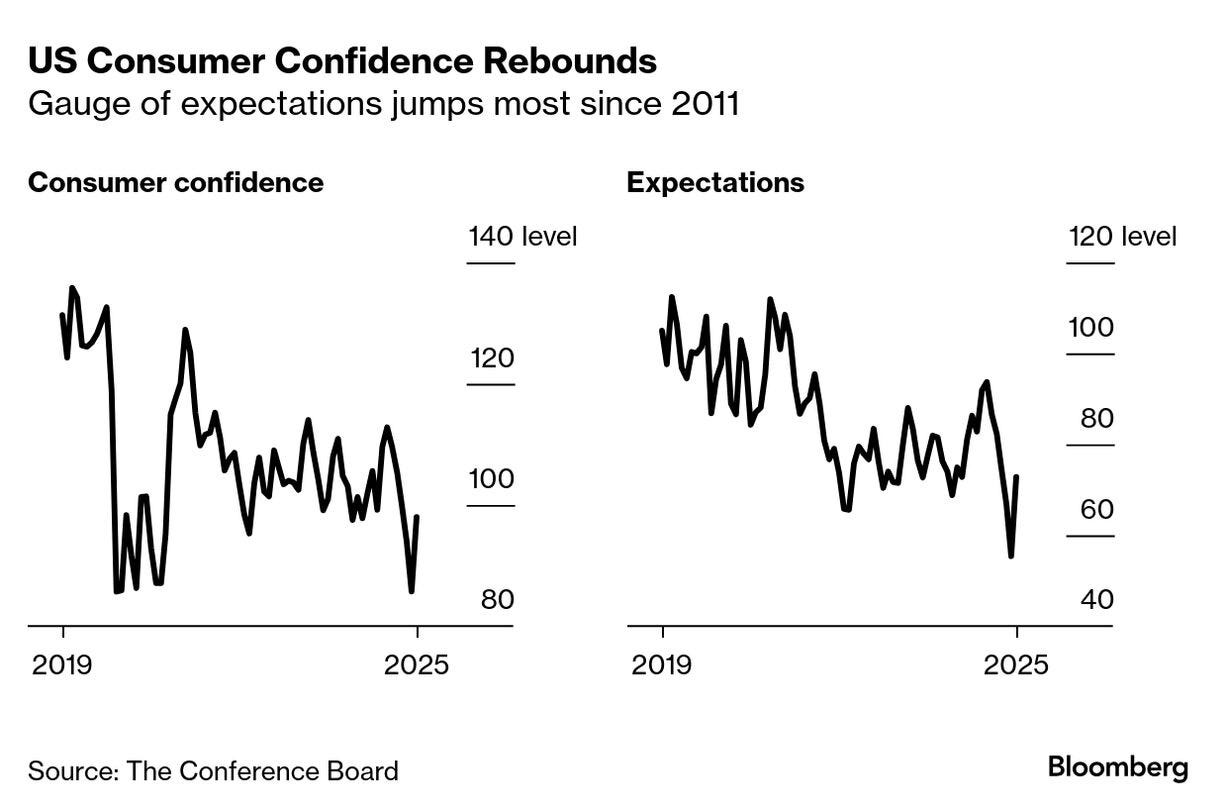

In May, The Conference Board’s consumer confidence index posted its biggest monthly gain in four years, jumping 12.3 points to 98. That’s not just a rebound—it’s a signal. A gauge of expectations for the next six months surged by the most since 2011, while present conditions improved across nearly every demographic. The message is clear: Americans are starting to believe again.

What changed? Politics, mostly. The Trump administration took its foot off the gas on extreme tariff threats, opening the door to a temporary détente with China and fresh momentum on U.S.–EU trade talks. That shift in tone sparked optimism not just among voters, but on Wall Street. Equity markets snapped a four-day losing streak. The S&P 500 jumped 2%, Treasuries rallied, and the dollar rose across the board.

This renewed confidence doesn’t just benefit consumer sectors—it stabilizes the backdrop for investment, lending, and development decisions across the real estate world. Capital likes clarity, and for now, the threat of a full-blown trade war appears to be on pause.

For developers, that means debt markets may stay more favorable than feared. For institutional investors, improved consumer sentiment could signal continued resilience in retail spending, housing demand, and rent collections. And for all of us, this could mark a moment of recalibration where uncertainty is replaced—however temporarily—by momentum.

Markets are emotional, and sentiment drives more than just headlines. When consumers feel good, they spend. When capital feels safe, it moves. If this confidence uptick sticks, it could set the stage for a surprisingly strong second half of 2025. For now, it’s a green light to keep building—and a reminder that psychology moves markets as much as policy.