Back from the holiday and the headlines aren’t letting up.

President Trump once again took center stage in the markets Tuesday—this time, not with broad tariff talk, but a targeted gut punch. A proposed 50% tariff on copper sent futures in New York into their biggest one-day spike in decades. For those of us tracking input costs for ground-up construction or heavy renovation, this is more than political theater—it’s a real pricing signal. The volatility is back.

This copper move comes on the heels of Trump backpedaling (again) on his “reciprocal tariff” timeline, only to then drop another round of threats across more than a dozen countries. This version, he claims, is the final delay. If so, developers with steel, copper, and other materials exposure better start scenario-planning accordingly.

Meanwhile, inflation expectations—at least among consumers—aren’t buying into the fear. According to the NY Fed’s June data, one-year-ahead inflation expectations dipped to 3%, their lowest since pre-tariff chatter returned. Expectations for 3- and 5-year outlooks held steady at 3% and 2.6%, respectively. This suggests that for now, the broader market still believes the Fed—not politics—is in control of the price narrative.

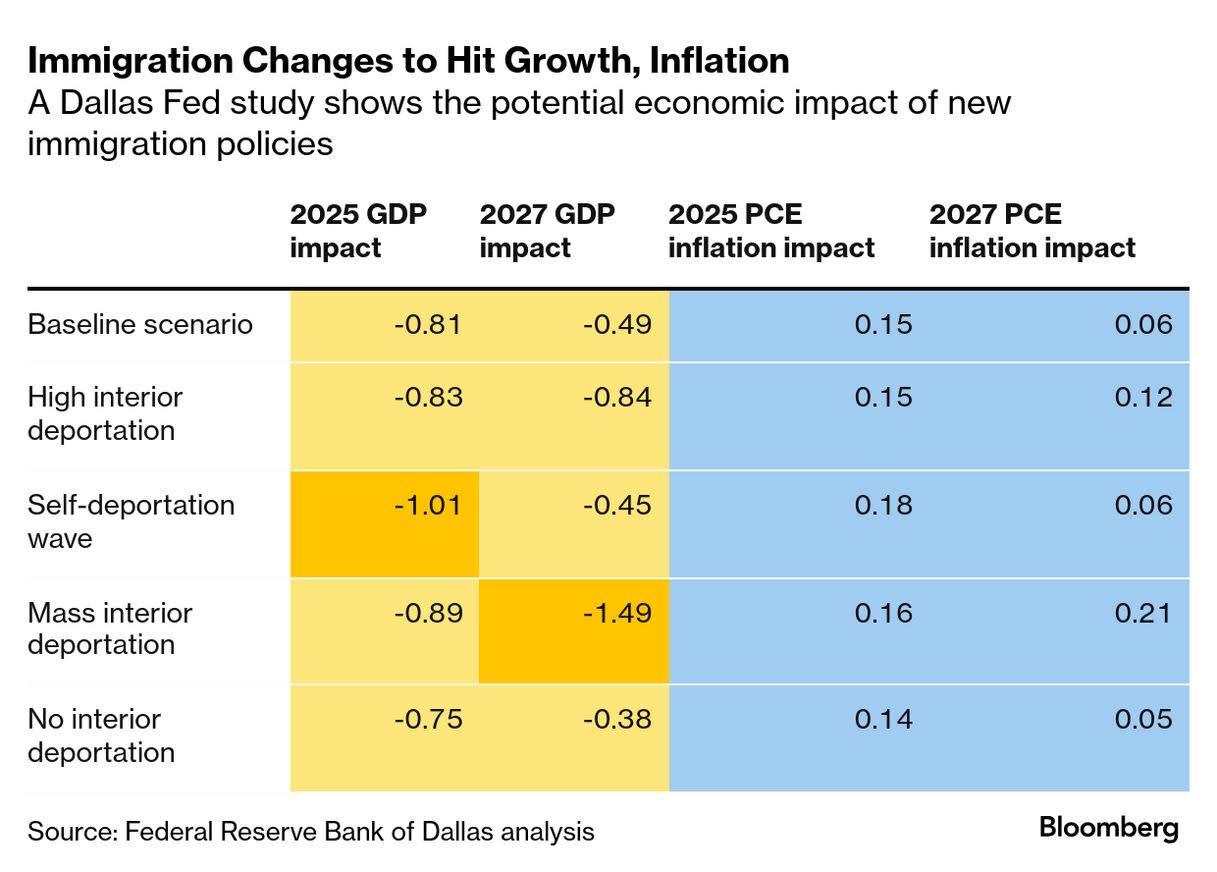

But the bigger macro shift for long-term investors may be immigration. A Dallas Fed study released this week forecast that Trump’s immigration policies could shave nearly a full point off GDP growth this year alone. They’re modeling a -0.8% GDP impact in 2025 due to reduced immigration and stepped-up deportation activity. And under a “mass deportation” scenario? The hit becomes a structural drag: -1.5% by 2027.

For real estate, this isn’t just theory. The construction labor force, tenant base, and broader consumption patterns in many growth markets—especially Sun Belt metros—are tightly linked to immigrant populations. Restrictive policy here isn’t just ideological. It’s inflationary on labor and deflationary on growth.

One more item investors should watch closely: sovereign wealth money is moving. Kuwait’s Investment Authority just dumped $3.1 billion in Bank of America stock, walking away from a stake that dated back to its crisis-era rescue of Merrill Lynch in 2008. This follows Warren Buffett quietly shrinking his BofA position. It’s another sign that institutional capital is cooling on big U.S. banks, and that capital is rotating. Smart money is exiting, not entering, some of the most reliable names in financial services.

If you’re trying to track where the winds are shifting this summer—on inflation, immigration, and institutional flows—this week brought the early signals. In times like these, being early with your thesis isn’t a luxury. It’s a requirement.

And no, the government can’t take away your citizenship, no matter what anyone tweets. That one’s still in the Constitution.

Daniel Kaufman