The commercial real estate market is finally showing signs of life—but don’t pop the champagne just yet.

Yes, prices are inching upward. But behind that modest rebound lies a cocktail of stalled rate cuts, rising tariffs, and mounting investor anxiety. The optimism we saw in early 2024 has given way to something far more complicated in 2025: a recovery that’s happening in slow motion—and with serious headwinds.

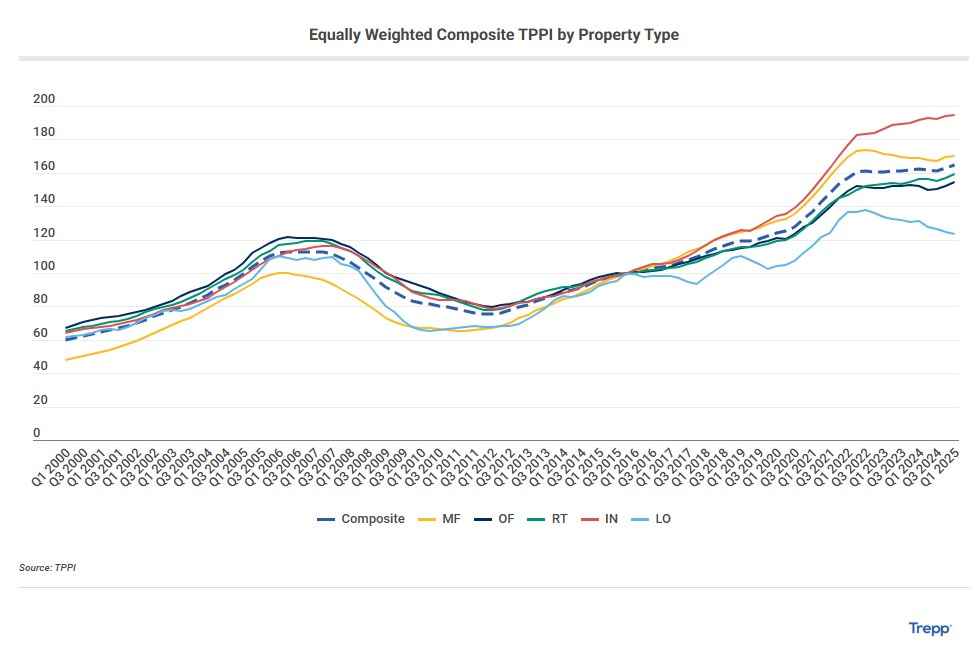

I dug into the latest data from Trepp’s Property Price Index, and the story it tells is nuanced. Some sectors are stabilizing. Others are quietly slipping. And all of it is playing out against a backdrop of monetary uncertainty and geopolitical friction that makes deal-making more complex—and more cautious—than it’s been in years.

Let’s break it down.

📊 The Market Moves… Cautiously

In Q1 2025, the Trepp index showed a slight uptick:

-

Equally Weighted Index (EW): +1%

-

Value Weighted Index (VW): +0.86%

That’s good news—on the surface. But the VW index is still down almost 10% from its 2022 peak, and that gap says a lot. Big-ticket deals are still soft. Capital is tighter. And while there’s movement, it’s hesitant and uneven.

Why? Because while we did get that long-awaited rate cut at the end of 2024, any hope for further easing has all but evaporated. Add in newly announced tariffs and a fresh wave of global trade uncertainty, and suddenly the path forward feels… murky.

💡 Sector by Sector: Who’s Holding Up—and Who’s Hurting

Here’s what’s actually happening under the hood:

🏢 Multifamily: Split Personality

-

EW: +0.47%

-

VW: -0.60%

Lower-tier, workforce housing is holding steady—or even gaining—as affordability pressures keep demand strong. But Class A assets in oversaturated Sun Belt markets are struggling. Cap rates are rising and absorption is slowing.

🏢 Office: Not Dead Yet

-

EW: +1.72%

-

VW: +0.66%

Yes, the headlines say office is dead—but the numbers suggest a market that’s trying to bottom out. Return-to-office mandates are helping, but costs remain a drag and recovery depends heavily on local fundamentals.

🛍️ Retail: Two Markets

-

EW: +1.66%

-

VW: +0.50%

Luxury retail centers and experiential concepts are thriving. Meanwhile, mid-tier retail continues to wrestle with e-commerce pressures. And tariffs could make things worse for supply chain-heavy operators.

🏭 Industrial: Still Hot, But Watch the Edges

-

EW: +6% since 2022

Data centers, warehousing, and logistics remain the darlings of the cycle—especially with AI demand surging. But with tariffs rattling global supply chains, volatility is very much still in play.

🛎️ Lodging: Cooling Off

-

EW: -0.55%

-

VW: -5.95% YoY

Travel has softened, especially in urban and business travel segments. Oversupply in certain markets is dragging down performance, and consumer confidence isn’t helping.

🧭 The Big Picture: A Fragile Rebound

Let’s be clear: this isn’t a bull run—it’s a tentative bounce. Yes, we’re seeing upward momentum, but the rally is fragile and increasingly sector-specific.

Investors aren’t betting on broad recovery. They’re picking spots, getting selective, and rebalancing based on fundamentals—and risk exposure. Sectors like multifamily and retail are becoming deeply bifurcated, and even industrial isn’t immune from trade turbulence.

Monetary policy isn’t the tailwind we hoped for. Trade policy is becoming a wild card. And geopolitical tensions are starting to creep into underwriting models.

🚨 So What Should You Be Watching?

-

Will the Fed stay frozen through the rest of 2025?

-

Will tariffs derail the recovery in industrial and retail?

-

Can multifamily fundamentals hold up under affordability strain?

-

Are we finally seeing the bottom in office—or just a pause?

If you’re an investor, developer, or fund manager—these are the questions that matter right now. And I’ll be diving deeper into each one in the coming weeks.

Like what you’re reading?

Subscribe and come back tomorrow—I’ll be unpacking where I see capital flowing next and what CRE sectors are most at risk in the second half of the year. There’s more turbulence ahead, but also opportunity—for those who know where to look.

—Daniel