Crypto is no longer about cartoon apes on late-night TV. The landscape has shifted—fast. These days, you’re more likely to read about a $10 million loss on a CryptoPunk than a viral NFT success story. And if you were one of the early sellers who forgot to pay taxes on those JPEG profits? You might be staring down a prison sentence. The Wild West days are over. But in some ways, the stakes are higher than ever.

So where are we now?

Let’s start with the markets. U.S. stocks closed last week with modest gains despite a late-session slide on reports that President Trump is once again threatening to fire Fed Chair Jerome Powell. The S&P 500 ended just barely positive, the Nasdaq was flat, and the Russell 2000 managed a small bounce. Energy and consumer staples outperformed. Tech lagged—especially Nvidia, which is facing more export pressure tied to the administration’s escalating stance on China.

But the more fascinating story right now isn’t in equities. It’s in crypto—and how Trump’s second-term promises are playing out as we near the 100-day mark of his presidency.

What Trump Promised the Crypto World

On the campaign trail, Trump positioned himself as the “crypto president,” vowing to:

-

Establish a national bitcoin reserve

-

Ensure all bitcoin is mined in the U.S.

-

Make America the crypto capital of the world

-

End what he called the “war on crypto” by reversing the Gensler-era crackdown

Those pledges earned him massive industry support. Coinbase, Ripple, and other heavyweights poured millions into Fairshake, the pro-crypto PAC, which raised more than $260 million in 2024 alone. The message was clear: the industry was betting on Trump to give it room to run.

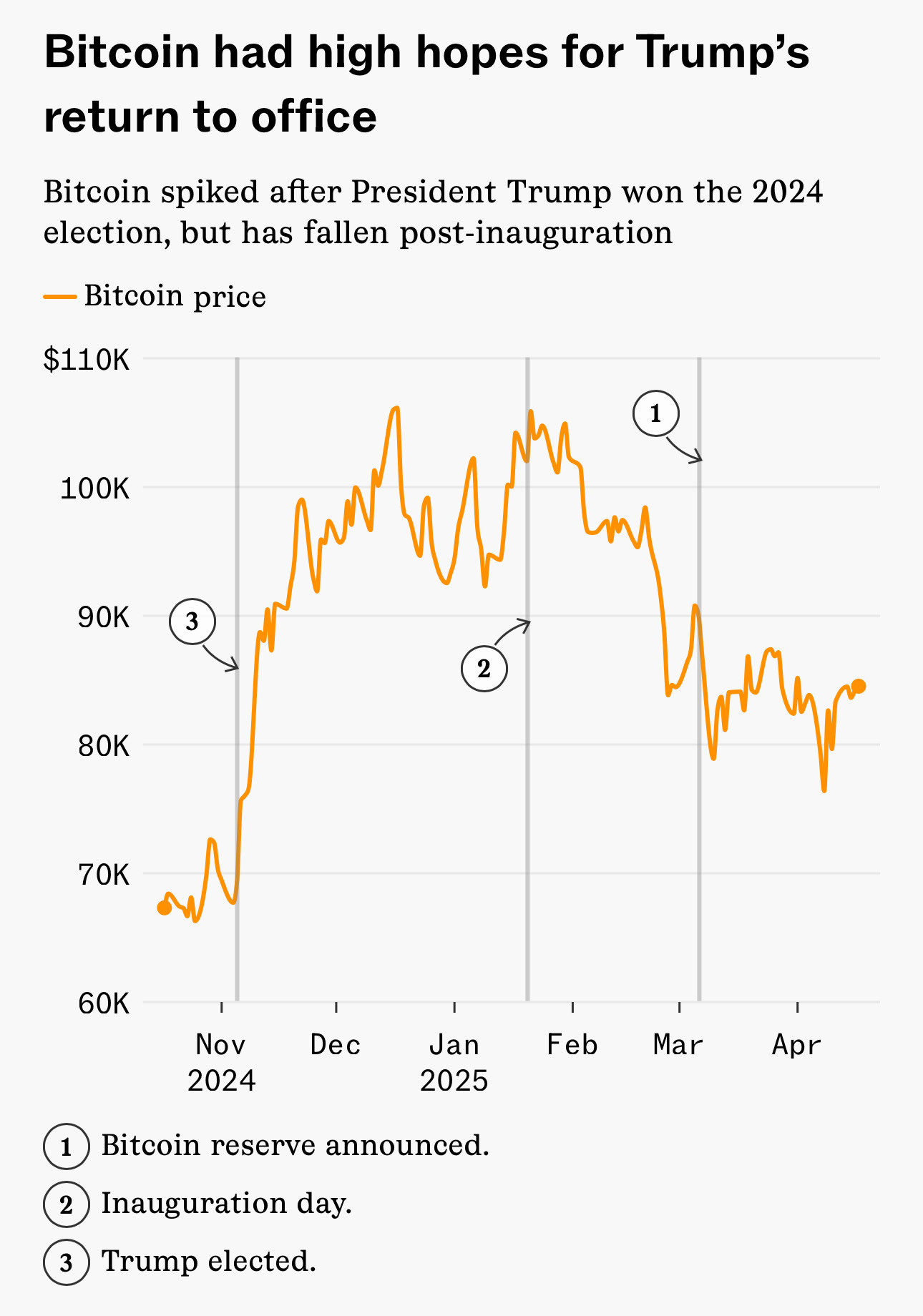

And for a moment, the market responded. On Inauguration Day, Bitcoin spiked to an all-time high of $109,114, riding the wave of optimism and policy promises.

But then reality set in.

So… Where Are We Now?

Bitcoin has since dropped back into the $80,000 range, and the total crypto market cap has declined from $3.36 trillion on Inauguration Day to $2.6 trillion as of mid-April. That’s still a massive market—but not quite the rocket ship the campaign envisioned.

Let’s talk wins and losses.

On the “win” side:

-

Trump reshaped the regulatory climate, appointing Paul Atkins as the new SEC chair.

-

Major enforcement actions were dropped against Coinbase, Kraken, Ripple, and others.

-

He named David Sacks as Crypto Czar and tapped longtime advocate Hester Peirce to lead the SEC’s new “Crypto Task Force.”

-

The first White House Crypto Summit may have underdelivered, but the tone from the top has shifted dramatically.

On the “loss” side:

-

Miners are struggling. Tariffs and power constraints are tightening margins.

-

The much-hyped Bitcoin Reserve got off to a messy start. The executive order came in January, but details weren’t released until March—and even then, it included altcoins, which disappointed Bitcoin maxis.

-

And despite campaign rhetoric, regulatory clarity remains murky. We’ve got a patchwork of rules, and stablecoin legislation is still slogging through Congress.

The Takeaway

As an investor, I’m watching all of this through a practical lens. The delta between campaign swagger and actual policy delivery is always wide—but in crypto, that gap can be volatile and expensive.

Yes, Trump’s administration is clearly more favorable to the industry than the one before it. But favorable doesn’t mean frictionless. There are still battles ahead, especially around mining, stablecoins, and how far the federal government will go in backing a digital dollar alternative.

Still, the fact that crypto has a seat at the table—and in many ways, a cheerleader in the White House—means this asset class isn’t going away. It’s evolving. And that evolution has implications far beyond digital coins. Tokenized real estate, DeFi capital markets, and smart contract-backed title systems are coming fast.

If you’re in real estate, you should be paying attention. This isn’t about chasing Bitcoin to $100K. It’s about understanding how the financial rails of the future are being rebuilt right now—and what that means for how we buy, sell, and securitize everything from homes to REITs.

I’ll be diving deeper into crypto’s intersection with real assets in an upcoming post. For now, the message is simple:

Crypto isn’t dead. It’s just getting started—again.

Daniel Kaufman

President, Kaufman Development