A troubling shift is quietly unfolding beneath the surface of the U.S. housing market: foreclosure activity is ticking up. According to the latest data from ATTOM, over 93,000 foreclosure filings were recorded in Q1 2025—a quarterly jump of 11%. While still below pre-pandemic norms, this marks the first notable rise after three straight quarters of decline.

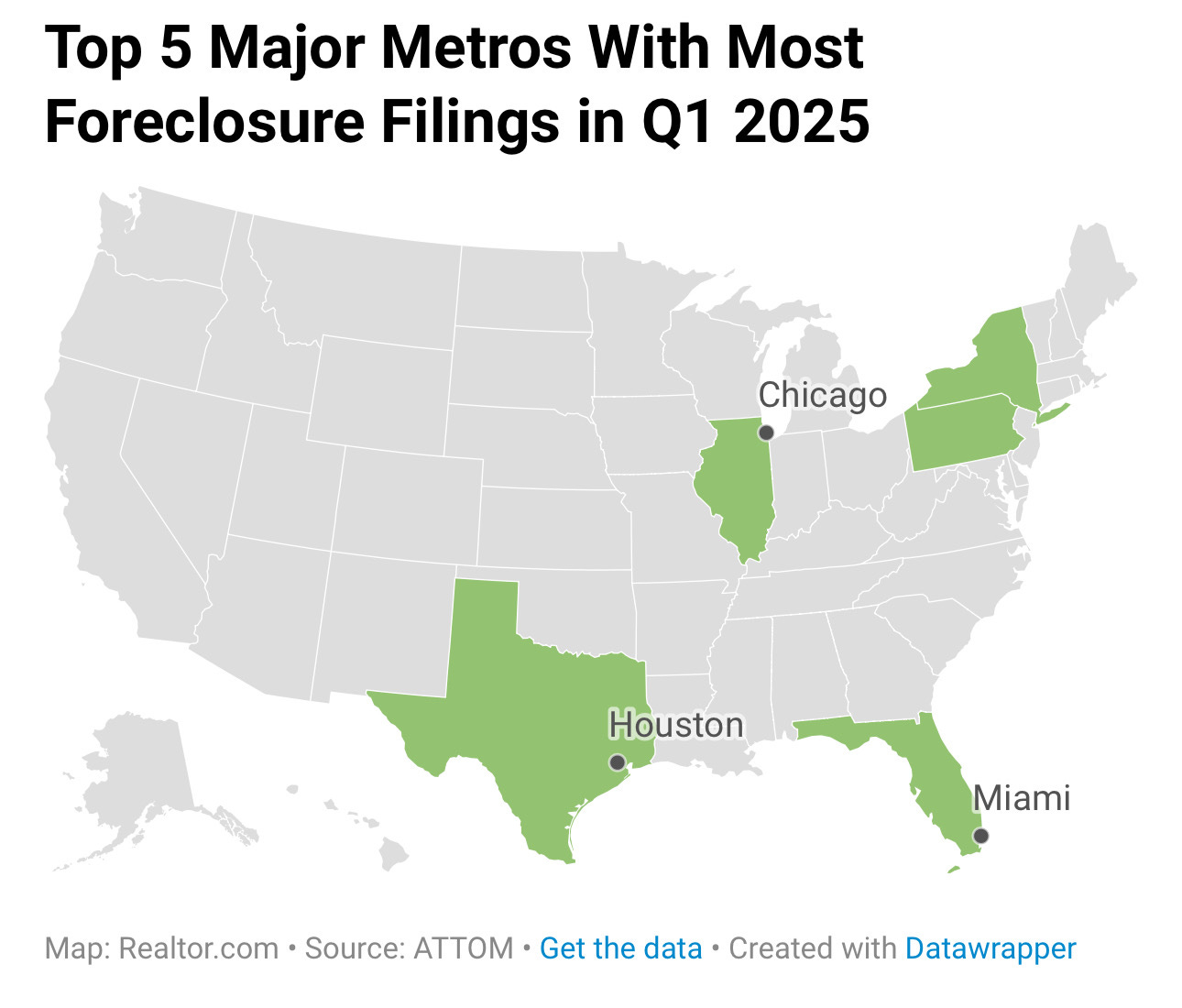

The metros leading the surge? Chicago (3,789), New York City (3,566), Houston (3,046), Miami (2,028), and Philadelphia (1,985). These aren’t small markets; they’re some of the country’s largest urban centers, and their scale can mask how deeply distress is beginning to set in.

What’s causing the spike? According to ATTOM’s Special Housing Risk Report, the answer lies in a mix of economic headwinds: affordability gaps, underwater mortgages, softening home prices, and persistent unemployment. While most homeowners still benefit from historically low interest rates and strong equity positions, that safety net is thinning in parts of the country where prices have stalled and cost-of-living pressures remain high.

“Some households facing financial strain could find themselves in a position where they can neither pay their mortgage nor pay off their loan with a home sale.” —Hannah Jones, Senior Analyst, Realtor.com

That quote should give any investor pause. But it should also turn on the radar.

This geographic snapshot underscores just how widespread—and concentrated—early signs of distress have become. Chicago, New York, Houston, Miami, and Philadelphia top the list, with dense urban populations and diverse housing stock. What these metros share isn’t just scale, but exposure: many are grappling with affordability pressures, job market volatility, and overleveraged ownership. According to ATTOM, foreclosure activity in Chicago alone is up more than 18% year-over-year, while Houston’s inventory of distressed properties has grown 12% since Q4 2024. These are not fringe markets—they’re bellwethers. When foreclosures rise in cities like Chicago and New York, it’s not just local—it’s systemic.

Looking ahead, we anticipate continued upward pressure on distress in high-cost, high-tax states—especially where insurance costs, property taxes, and stagnant wage growth are converging. If interest rates remain above 6.5% through mid-2025, we could see foreclosure starts climb another 10–15% by Q3, particularly in metros with expiring rate buydowns and overstretched FHA borrowers. For investors, these markets are now critical to monitor for early-entry opportunities in both distressed single-family assets and undervalued multifamily repositioning plays. It’s also worth watching how these conditions could spark bulk note sales and REO portfolios coming to market later this year, especially in judicial foreclosure states with significant court backlogs now clearing.

The Bigger Trend: A Cautionary Signal

Even though the current numbers don’t suggest a 2008-style meltdown, the data reveals a concerning trend. Foreclosures are no longer just edge cases—they’re starting to reappear in scale. And while the macro narrative remains strong—low inventory, locked-in mortgage holders, and resilient buyer demand—the micro realities in certain markets are flashing red.

States with the highest foreclosure rates this quarter include:

-

Delaware (1 in every 761 units)

-

Illinois (1 in 857)

-

Nevada (1 in 874)

-

Indiana (1 in 976)

-

South Carolina (1 in 1,021)

Cities like Columbia, SC; Lakeland, FL; and Riverside, CA also top the list.

This matters not just for economists, but for real estate operators, investors, and developers navigating a landscape that’s getting more fragmented—and more bifurcated.

Where the Opportunities Are

Here’s the part most headlines miss: disruption breeds opportunity. For savvy investors, these market dislocations can unlock serious upside.

-

Distressed acquisition pipelines are beginning to reopen, especially in submarkets where prices have overcorrected or financing is tight.

-

Single-family rental (SFR) operators may find opportunities to acquire inventory below replacement cost—especially in foreclosure-prone states where demand for rentals remains strong.

-

Value-add multifamily opportunities may re-emerge as owners face debt maturity risks, softening rents, or operational distress.

-

Modular and workforce housing developers—especially those aligned with public-private partnerships—can step into the void in cities facing affordability gaps and rising default activity.

At Kaufman Development, we’re already mapping this trend against market-by-market fundamentals and evaluating entry points where the distress is mispriced or temporary. We’re also watching how capital markets react—particularly how note sales, REO pipelines, and off-market distressed portfolios begin to flow into opportunistic hands.

What Comes Next

The road ahead isn’t just about watching foreclosure filings—it’s about understanding where macro headwinds intersect with localized stress. Not every market will crack. But some already are.

In moments like this, it’s not just about capitalizing on the cracks—it’s about helping repair them. Investors who focus on solutions-oriented housing, who can move fast and think long, will find this cycle presents a rare chance to scale.

Stay close. More to come.

Daniel Kaufman is the founder of Kaufman Development and Oldivai, and writes regularly about real estate strategy, market risk, and capital trends at the intersection of housing and policy.

Follow more insights at danielkaufmanre.com or subscribe here on Substack.