www.danielkaufmanre.com | Kaufman Development

We’ve been bracing for a wave—and it hasn’t hit. Yet.

For four straight months, many economists—and just about every talking head on CNBC—have been warning that inflation would come roaring back, fueled by Trump’s renewed tariff war. But once again, the data has defied expectations. Core inflation rose just 0.1% in May, despite the constant drumbeat of trade volatility, rising grocery costs, and a growing pile of geopolitical risks.

But don’t get too comfortable. Beneath the surface, pressure is building—and the foundation of America’s monetary policy may be starting to crack.

What the Inflation Numbers Really Say

While the headline from the Bureau of Labor Statistics may read calm, retail giants like Walmart and Target are already flagging price pressures, especially as the cost of imported goods creeps higher. Automakers like Ford and Subaru are issuing similar warnings.

The Fed’s own surveys echo this tension: while recent price increases have been “moderate,” several regions are forecasting “substantial” price growth ahead.

So what’s holding inflation back—for now?

Many of Trump’s proposed tariffs are still sitting idle, allowing markets a temporary reprieve. But this delay might be misleading investors into complacency. Treasury Secretary Scott Bessent has spun this as a win, suggesting that Trump’s tariff strategy has “challenged a decades-old status quo.” In reality, it’s a pause, not a pivot.

The Real Threat? The Dollar

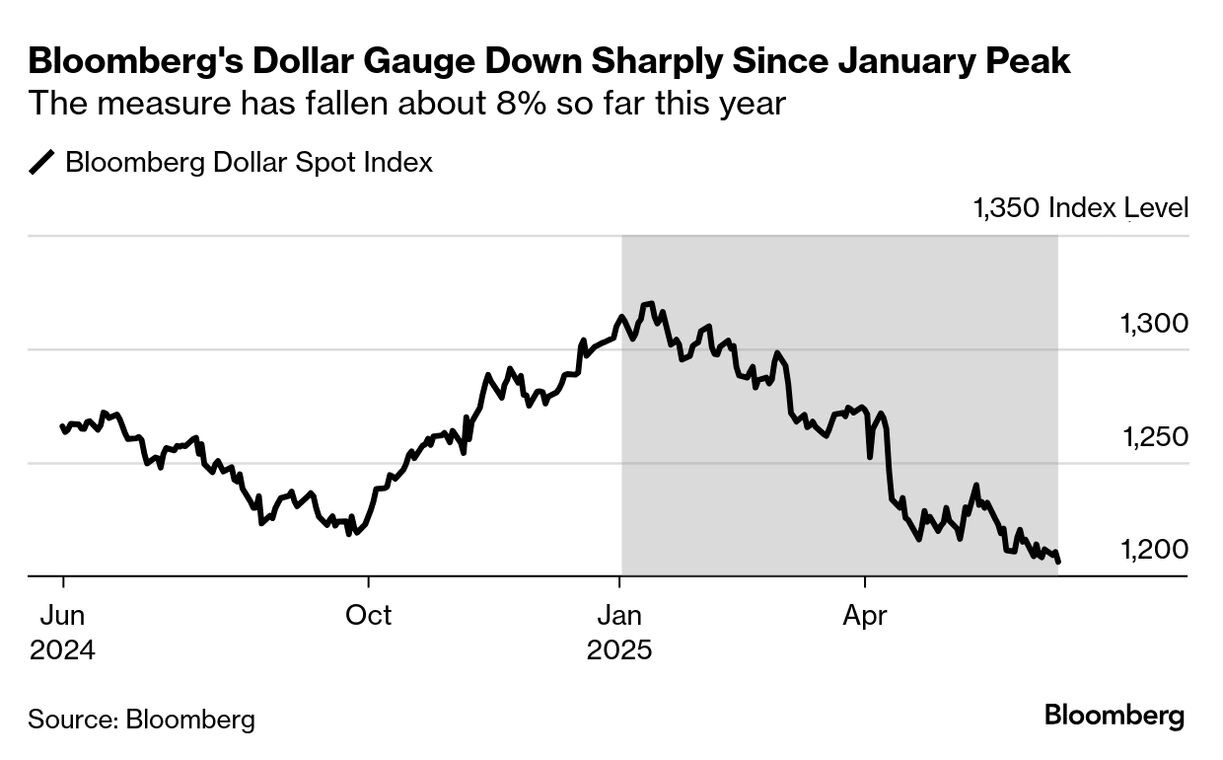

Investors aren’t just worried about prices—they’re worried about the value of the dollar itself.

Jeffrey Gundlach of DoubleLine Capital put it bluntly: “There’s an awareness now that the long-term Treasury bond is not a legitimate flight-to-quality asset.” America’s spiraling debt and rising interest expense have made dollar-denominated assets look fragile.

This isn’t just theoretical. Gundlach is already rotating into foreign currencies. So is Paul Tudor Jones, who sees a sharp drop in the dollar as short-term rates are slashed in the coming year. His forecast? A 10% decline in the dollar’s value—a shift with profound implications for anyone holding U.S.-based real estate, bonds, or currency-heavy assets.

Tax Shocks and the “Revenge Clause”

The evolving GOP tax package is also worth watching. Proposals include slashing the SALT deduction cap from $40,000 to $30,000 and revising a lesser-known clause—Section 899, dubbed the “revenge tax”—that could spook foreign investors out of U.S. markets. That’s a real risk for developers and sponsors relying on international capital.

With Wall Street already anxious about the tax bill’s multi-trillion-dollar impact, any misstep here could accelerate capital flight, further weaken the dollar, and tighten financial conditions across real estate and credit markets alike.

What I’m Watching (And You Should Too)

If you’re in real estate, here’s the real signal:

-

Watch the bond market. Treasury yields are the canary in the coal mine.

-

Track the dollar. A weakening dollar reshapes the investment calculus—especially for foreign buyers and U.S. developers exposed to import pricing.

-

Stay ahead of tax shifts. Policy risk is capital risk. Developers, especially those using offshore LPs, need to be laser-focused on Section 899 and SALT negotiations.

We’re not in a crisis yet. But the ground is shifting beneath us.

At Kaufman Development, we’re already repositioning some of our underwriting assumptions and hedging risk on import-exposed construction inputs.

If you’re an investor, operator, or sponsor—this is the time to prepare, not react.

Want to know how we’re adjusting strategy in light of these macro shifts?

Subscribe to stay ahead of the curve. We’ll be unpacking more opportunities, risks, and signals in next week’s post.

📩 www.danielkaufmanre.com – The pulse of modern real estate investing.