The great migration boom we’ve been tracking since 2020 is officially cooling. After years of explosive population shifts driven by remote work, housing affordability, and policy flight, 2024 marked a turning point. The pace is down, the patterns are shifting, and the next chapter is being written more quietly—but it’s no less important for developers and investors who are paying attention.

According to Placer.ai and Census data, domestic migration has decelerated nationwide. Texas and Florida, two states that couldn’t miss in 2021 and 2022, have seen inflows flatten. In fact, Florida is now showing signs of net population loss—something few of us would have predicted this soon. And while California, New York, and Illinois are still losing residents, those losses are tapering.

But this isn’t just about where people are leaving. It’s about where they’re still going—and where new opportunity is quietly building.

The New Frontier: South Carolina, Idaho, and North Dakota

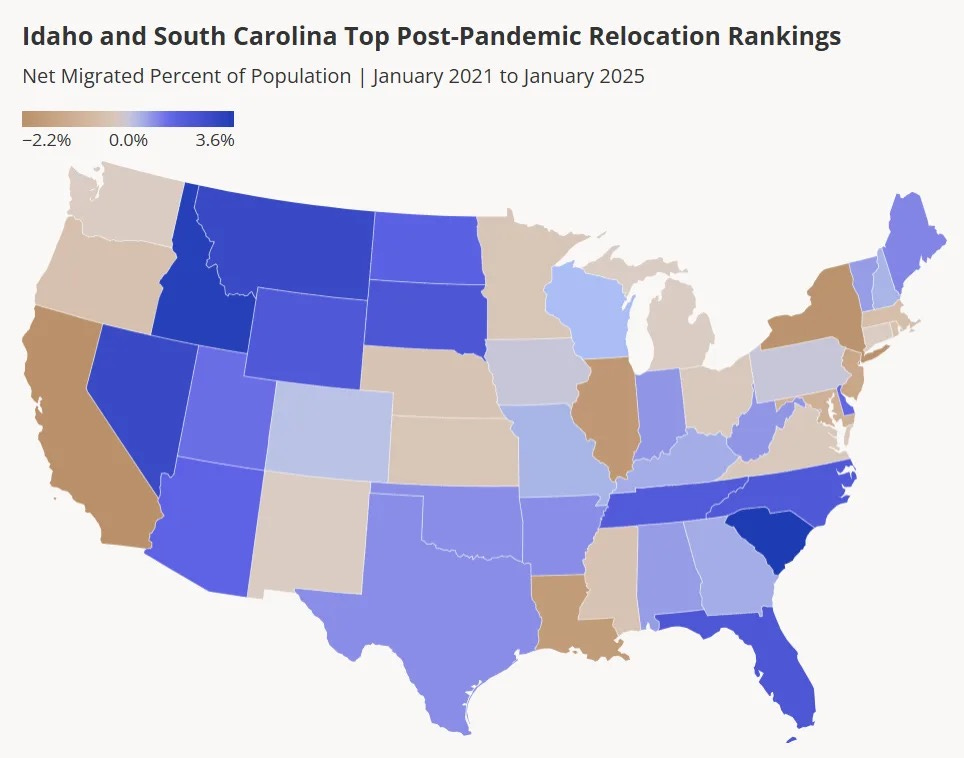

From 2021 to 2025, South Carolina and Idaho have led the country in net domestic migration as a percentage of population, growing by 3.6% and 3.4% respectively. These are not just retirement markets or fringe alternatives—they’re rapidly maturing housing economies with meaningful job growth and emerging institutional interest.

North Dakota—quietly and without fanfare—has begun attracting a modest but consistent stream of new residents. Energy, agriculture tech, and inflation-driven wage arbitrage are all part of the story. It’s a state that may not show up in headlines, but developers who can tolerate some cold weather and navigate permitting may find real runway.

Phoenix Isn’t Done Yet

In metro terms, Phoenix is still the outlier among America’s ten largest cities, clocking in with positive net migration in 2024 while others stalled or reversed. While Los Angeles, New York, and Chicago are stabilizing, and Miami continues to lose residents due to spiking housing costs, Phoenix is pulling in high-income movers from more expensive metros.

The story in Phoenix remains straightforward: a strong job market, housing that’s still relatively affordable, and a culture that continues to appeal to both young professionals and early retirees.

This isn’t just a macro win—it’s a strategic window. With build costs softening and multifamily starts slowing, the capital that can strike now in Phoenix’s infill and mid-density corridors is going to have an edge in 2026 and beyond.

The Surprising Rebound of the Rust Belt

Yes, really.

Ohio, Michigan, and Pennsylvania have quietly flipped from net-negative to slightly positive domestic migration. These markets have long suffered from brain drain and urban decline, but affordability has now become an asset. As Sun Belt housing costs rise and remote work endures in hybrid form, talent is returning to Tier 2 cities with better price-to-wage ratios.

For developers, this presents a new challenge. The demand is real, but it’s modest. Projects here won’t pencil on aspirational pro formas or overbuilt amenities. But if you understand working-class housing, adaptive reuse, or SFR-to-rental strategies, these are markets where capital can still outperform risk.

The Big Takeaway: Migration Has Evolved, But It Hasn’t Stopped

It’s tempting to read the headlines and assume mobility is over. In reality, the story has just gotten more nuanced. The days of explosive growth in Austin or Tampa may be behind us (at least for now), but the American population is still on the move. It’s just moving to places that most investors haven’t fully priced in yet.

South Carolina, Idaho, North Dakota, Phoenix, and parts of the Midwest are where the next cycle will begin. Not loudly. Not all at once. But the early signs are there.

The question is: Will you be early, or will you be chasing yield after it’s already been harvested?