In a market still defined by caution, Q1 2025 delivered a quiet but important signal to multifamily investors: the fundamentals are stabilizing—and in some key markets, they’re starting to accelerate.

Absorption Outpaces Deliveries for the First Time Since 2021

Over 102,000 apartment units were absorbed in Q1, a 12% jump from last year and nearly 40% above the pre-pandemic norm. That kind of velocity isn’t a fluke. It’s the result of persistent housing demand, fueled by steady household formation and a still-locked for-sale housing market.

Even more telling: for the first time since the boom years of early 2021, demand outstripped supply. With only 95,000 new units delivered—a 25% drop from Q1 2024—the market is starting to rebalance. Developers, lenders, and operators who’ve been waiting for the flood of supply to dry up are now seeing it happen in real time.

Construction Pipeline Shrinks—and That’s a Good Thing

We’ve been talking for over a year about how the pullback in starts would eventually set the stage for a recovery in fundamentals. That moment has arrived. The national pipeline sits at just 545,000 units—the lowest since 2018—and starts are down 36% year-over-year.

Markets that overbuilt are finally hitting the brakes. Texas leads the retreat, with DFW, Austin, and Houston alone shedding nearly 60,000 units from the pipeline. Phoenix and Atlanta are following suit, each down more than 15,000 units.

Vacancy rates ticked down slightly—just 10 basis points—but it’s the trajectory that matters. This isn’t about a quick bounce. It’s about a gradual tightening that will support rent growth as supply pressure continues to ease.

Rent Growth Holding the Line Amid Uncertainty

Despite economic volatility, rents grew 2% year-over-year in Q1—right around the historical average. More encouragingly, growth has been slowly climbing since late 2023, moving from sub-1.5% to 2.02% in Q1.

The Midwest and Northeast are leading the charge, with YOY rent growth of 3.9% and 3.2%, respectively. Even San Francisco and San Jose—two markets that have struggled for years—are now showing signs of life.

Of course, not every market is in the green. Austin (-2.7%) and Denver (-2.2%) are still digesting major deliveries, but they’re the exception, not the rule.

Why This Matters

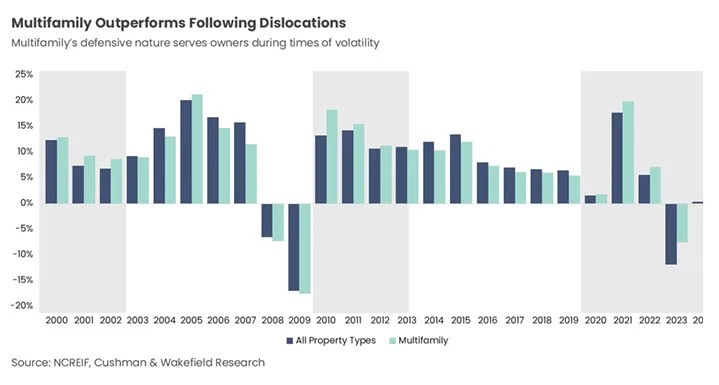

Multifamily is proving, once again, that it’s the most resilient asset class in commercial real estate. Net move-ins are up, construction is down, and rent growth is back in positive territory—even in a tough macro environment.

For developers and investors, the message is clear: the overhang is lifting. If demand holds—and history suggests it will—the next 12 to 18 months could represent a rare window to buy into recovery.

Want More of This?

This was just the Q1 pulse check. In my next post, I’ll break down where cap rates are heading, which markets are mispriced, and what I’m watching in the debt markets that could shift the outlook dramatically.

Subscribe and stay ahead. Smart capital already is.