The Week in Review – May 2025

Before the headlines turned to Vatican smoke signals and Bitcoin’s victory lap, a new U.S.–UK “trade deal” made its debut from the Oval. I use that term loosely. Call it a framework, call it a handshake, but don’t call it clarity.

The big points?

• Tariffs on British aluminum and steel are coming down

• The U.S. will allow up to 100,000 British cars at a lower rate

• Ethanol and beef are back on the table (literally)

Markets loved it. Risk-on sentiment lifted the S&P, Nasdaq, and Russell. Bitcoin cracked $100K again, which is exactly the kind of reaction you’d expect when people believe that maybe—just maybe—we’re pulling back from tariff mania.

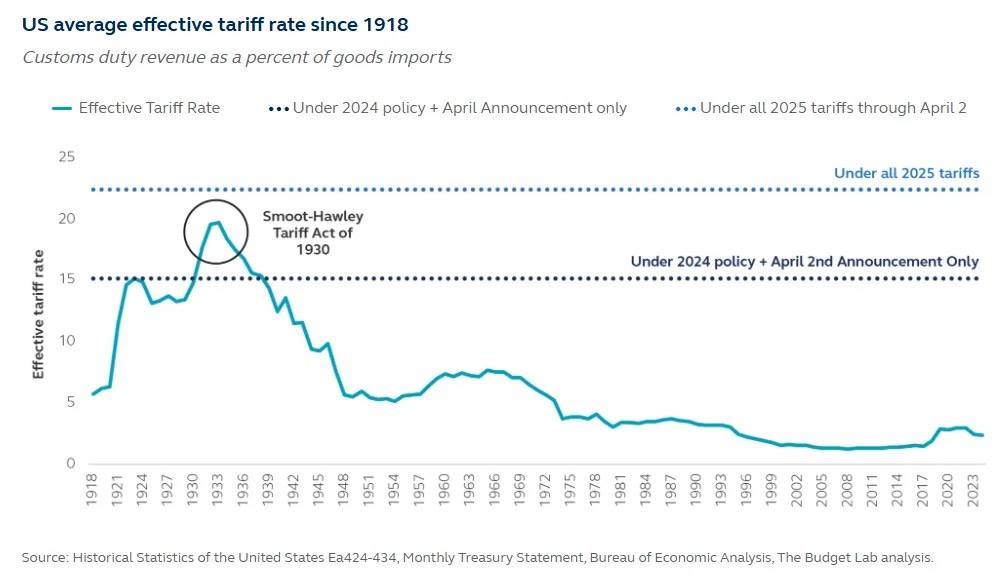

But let’s not lose the thread here: tariff policy is now real estate policy. The projected effective U.S. tariff rate is on track to hit 22.4% this year—higher than anything we’ve seen since Smoot-Hawley in 1930. For those of us trying to model construction pipelines or price lumber six months out, that’s not noise. That’s the macro.

Multifamily: Still Standing, But Watch Your Step

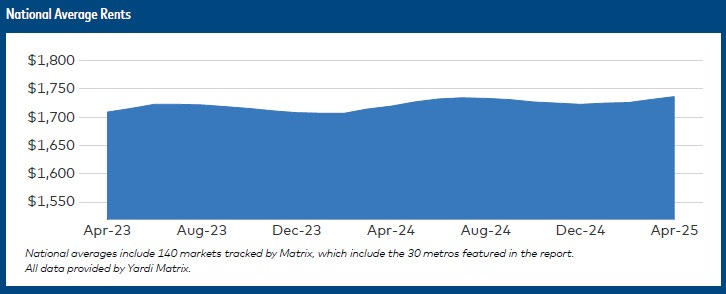

Rents rose slightly in April—$5 nationally according to Yardi Matrix—bringing the average to $1,736. The Renter-by-Necessity segment is still doing the heavy lifting with 2.1% YoY growth, while lifestyle product stays flat. In a world where supply is finally catching up to demand, RBN continues to outperform because necessity, unlike lifestyle, doesn’t yield.

Where the rent growth is:

-

New York City: +5.8% YoY

-

Columbus, Philly, KC: close behind

-

Raleigh: +1.0% MoM (short-term rebound)

Where it’s fading:

-

Austin: -5.6%

-

Denver: -3.9%

-

Phoenix: -3.1%

-

Charlotte, Dallas, Orlando: all negative MoM

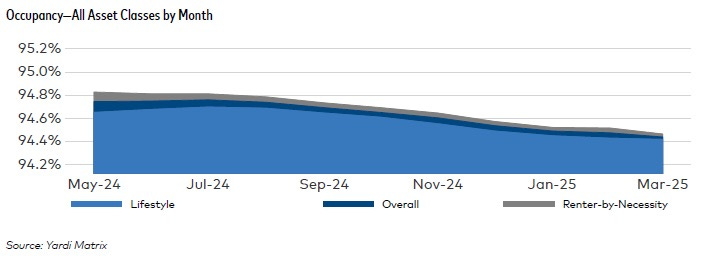

SFR is getting clipped too, especially in Sun Belt metros like Austin (-4.4%) and Dallas (-2.1%). Occupancy is holding at 94.8%, but rent growth has flatlined. This is what happens when build-for-rent supply runs hot without enough wage growth to match it.

Capital markets? Frozen.

The CMBS market stalled out in April. Spreads widened by 30 bps. Roughly $15B in potential deals just evaporated. Agency lenders are still in the game, but borrowers are leaning on floating-rate structures now that rates are bouncing again. The fear isn’t inflation—it’s uncertainty. And uncertainty is what freezes credit.

Also This Week: Entertainment Companies Are Finally Admitting They Can’t Be Everything

Comcast is spinning off its cable bundle into something called “Versant.” Warner Bros. Discovery may follow. Everyone wants to keep the IP and dump the cable drag. Investors seem into it, and the logic tracks: when a business is too complicated to value, eventually the market just stops trying.

I bring this up not because you’re investing in Comcast, but because it’s the same story across sectors: shed the drag, highlight the upside, simplify the story. That’s a lesson real estate owners, developers, and LPs should pay attention to as we all reprice assets, portfolios, and strategies heading into a very different Q3.

Looking Ahead:

-

Watch Sun Belt lease-up velocity. We’re nearing oversaturation in a few key markets.

-

Midwest and Northeast are looking increasingly stable—not sexy, but solid.

-

Capital is rotating toward less exposed geographies and sponsors who can weather volatility.

-

Keep an eye on Washington. Tariff policy is now development policy.

Wrap-Up Quote:

“The deal might be half-written, but the message is loud and clear: trade, rates, and rent are colliding—and if you’re not reading between the lines, you’re probably underwriting the wrong ones.”

About the Author:

Daniel Kaufman is the founder of Kaufman Development and managing partner of the Kaufman Family Office. He builds what others overlook, writes what others avoid, and invests where the story hasn’t been told yet. Learn more at www.danielkaufmanre.com.