There’s an old saying in real estate: markets move on confidence. If that’s the case, May just rang the alarm bells.

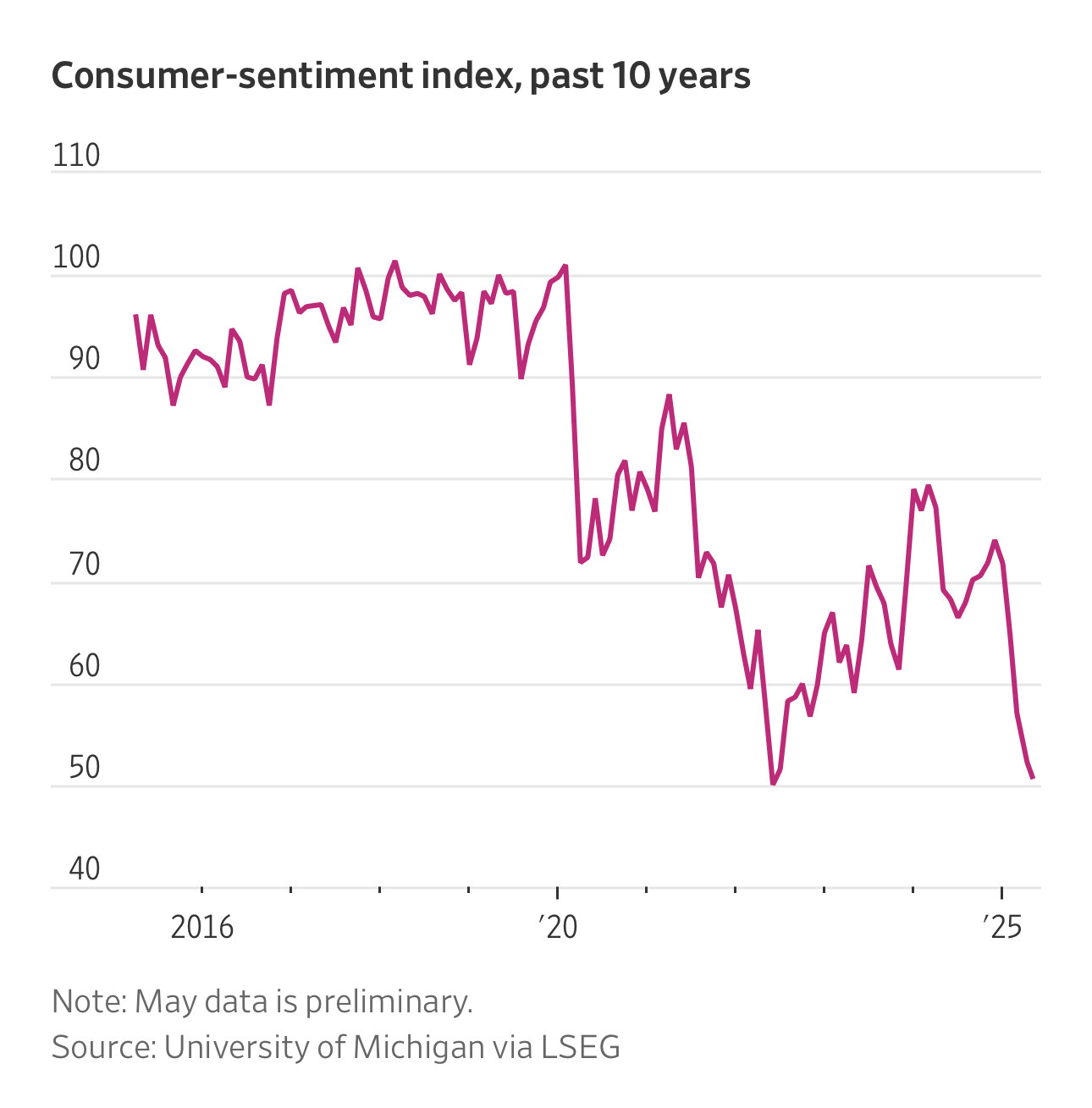

According to the University of Michigan’s preliminary numbers, U.S. consumer sentiment has dropped to 50.8—the second-lowest reading on record. To put it into perspective, the only time sentiment was worse was in June 2022, when inflation and interest rate fears collided to push the index to 50.0.

What’s driving this renewed anxiety? One word keeps coming up: tariffs.

Nearly three-quarters of consumers spontaneously mentioned tariffs in May—up from 60% in April—as worries mount over rising costs for everyday goods. This isn’t just an abstract economic stat. It’s a signal that middle-class households are feeling the squeeze again. And when the consumer feels it, housing demand, discretionary spending, and developer margins are not far behind.

Here’s the kicker: consumer sentiment has now declined five months in a row and has plunged 30% since December. That’s not a dip. That’s erosion.

So what does this mean for developers and investors?

It’s time to read between the lines. The macro narrative is shifting—again. While inflation readings remain tame and employment steady, sentiment is a leading indicator. People tighten up before the data catches up. That means leasing velocity, retail traffic, and for-sale housing demand could soften before the Fed, the media, or your lender fully acknowledges it.

If you’re underwriting deals right now, pressure-test your rent growth assumptions. If you’re raising capital, get ahead of the sentiment story with your investors. And if you’re watching Washington, don’t underestimate how the return of the tariff era might shift both consumer behavior and development costs in the back half of 2025.

We’ve seen this playbook before. The winners are the ones who pivot early.

Daniel Kaufman