There’s been no shortage of noise around population loss and job flight from major urban hubs—particularly New York. But the latest data tells a different story. While Texas markets like Dallas and Austin are cooling, NYC remains the country’s largest engine of job growth. And beneath the headlines, smaller cities and college towns are quietly rewriting the map.

For real estate developers and investors, this reshuffling matters. It isn’t just about who’s growing fastest—it’s about where growth is becoming more durable, and why some cities are suddenly outpacing legacy leaders.

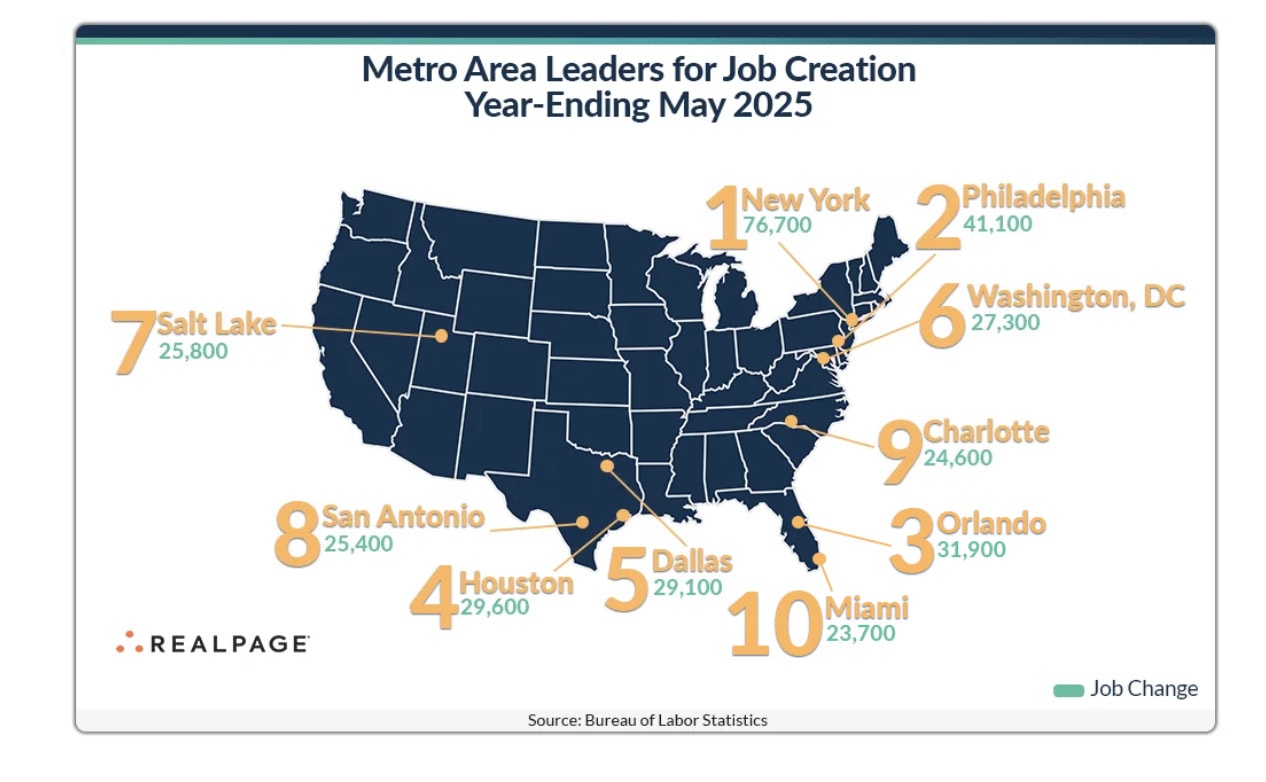

NYC: Still the Country’s Job Creation Anchor

Despite a year-over-year decline, New York City added 76,700 jobs in the 12 months ending in May—more than any other metro and the only city to clear 50K new jobs in the month.

In contrast to the public narrative, the city’s labor force is expanding. Revisions to job data earlier this year added 134,000 previously uncounted jobs to the city’s books, especially in construction, media, and government sectors. The Census Bureau also revised up the city’s population estimate by 87,000 people—largely driven by international migration.

In other words: NYC’s job market is not in decline. It’s stabilizing after a COVID-era whiplash and positioning for long-term strength, particularly in creative industries, tourism, and institutional sectors. And this stability matters in a world where many cities are now facing contraction.

Texas: Growth is Slowing, Not Stopping

Dallas and Houston each added around 29,000 jobs—but both slipped in the national rankings to #5 and #4, respectively. Austin dropped out of the top 10 for the first time in over a year, landing at #12.

These are still strong numbers, but the pace is slowing, and in this cycle, deceleration can be as important as direction. Developers in these markets need to watch leasing velocity closely—particularly for high-density or luxury product—and reconsider short-horizon assumptions around rent growth.

One bright spot: San Antonio reentered the top 10, suggesting that secondary metros within the state might hold up better in the next phase of the cycle.

The Rising Middle: Philadelphia, Orlando, Salt Lake, and DC

Mid-sized cities and emerging hubs are claiming a bigger share of national growth:

-

Philadelphia and Orlando jumped ahead of both Dallas and Houston in total job gains.

-

Salt Lake City and Washington, DC are gaining ground as steady performers.

-

Charlotte added 24,600 jobs but dropped four spots in the rankings.

-

Miami held onto the #10 slot, signaling consistent if unspectacular growth.

These shifts suggest a more diversified set of job centers—and for investors, that opens the door to regional plays that were once overlooked in favor of legacy Tier 1 growth markets.

Small Markets, Big Momentum

Where percentage growth is concerned, the leaders are not who you’d expect:

-

Myrtle Beach, SC and Charleston, SC top the national charts once again.

-

Fayetteville, AR and College Station, TX each posted 3.3% annual growth.

-

Champaign-Urbana, IL, Boise, ID, Huntsville, AL, and Tallahassee, FL all posted growth well above the 1.08% national average.

These smaller metros are benefiting from a mix of affordability, quality of life, and economic anchors like universities, tourism, and military bases. The catch? Limited housing supply and labor constraints mean investors need to move quickly and build smart.

What It All Means for Developers and Investors

Here’s how we’re reading the board at Kaufman Development:

-

NYC is outperforming the headlines—and still offers real value, especially in repositioning legacy assets or building near mass transit.

-

Texas isn’t broken—but it’s no longer the outlier. Expect flattening rent curves and longer lease-up periods.

-

Secondary metros are becoming prime-time. Think Philly, Salt Lake, and Orlando. The underwriting there requires nuance—but the demand story is getting better.

-

Small market growth is real, but fragile. We’re watching places like Huntsville and College Station closely, but staying cautious on exit liquidity and capex assumptions.

Final Thought

Job growth drives household formation. Household formation drives housing demand. And as demand shifts across the map, the most successful real estate investors won’t just follow the population—they’ll get ahead of it.

We’ll be there.

If this resonated with you, share it with your partners and subscribe for more real-time updates on where the market’s really moving. For our active projects and research, visit www.dkaufmandevelopment.com.