For the first time in modern history, the U.S. is set to lose more office space than it builds. Let that sink in.

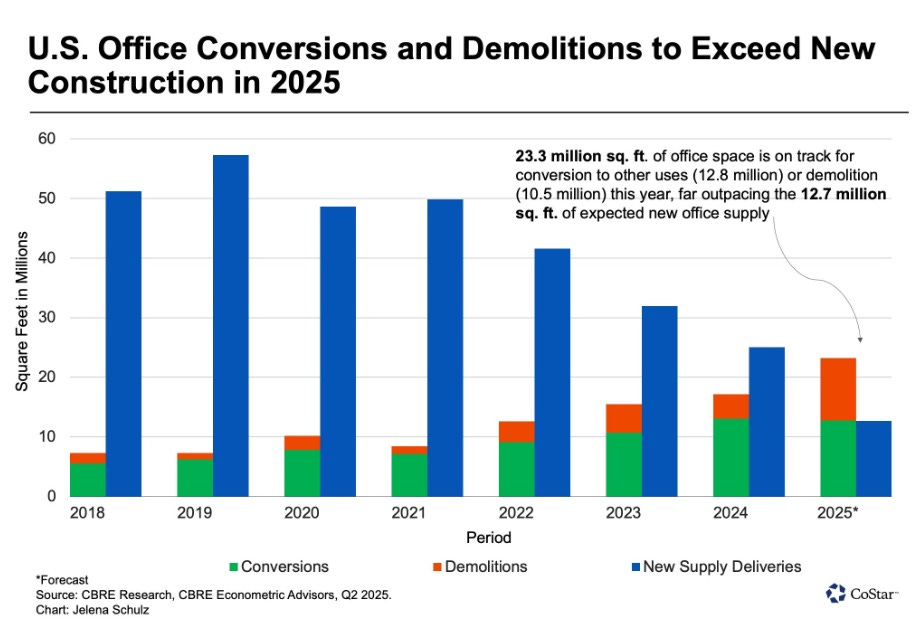

According to a new report from CBRE, 2025 will mark a major inflection point: 23.3 million square feet of office space will be demolished or converted—nearly double the 12.7 million square feet of new deliveries expected that same year. This isn’t just a shift in supply—it’s a transformation in how our cities function, and it’s going to have lasting consequences for real estate developers and investors.

The Era of Excess Is Over

Vacancies hovering around 19% nationally have made it clear: we’re not over a temporary dip—we’re staring down a structural realignment. Remote and hybrid work are no longer fringe—they’re foundational. And much of the office stock built in the ’70s and ’80s simply doesn’t serve today’s workforce or urban landscape.

The result? Demolitions and conversions are accelerating, especially in top-tier metros where land is too valuable to leave idle.

Where It’s Happening—and Why It Matters

Manhattan leads the way with 10.3 million square feet in conversions, followed by D.C., Houston, Chicago, and Dallas–Fort Worth. The DFW metro, in particular, is emerging as a case study in urban reinvention. Projects like The Sinclair, a $300M conversion of the former Energy Transfer HQ, are redefining central business districts.

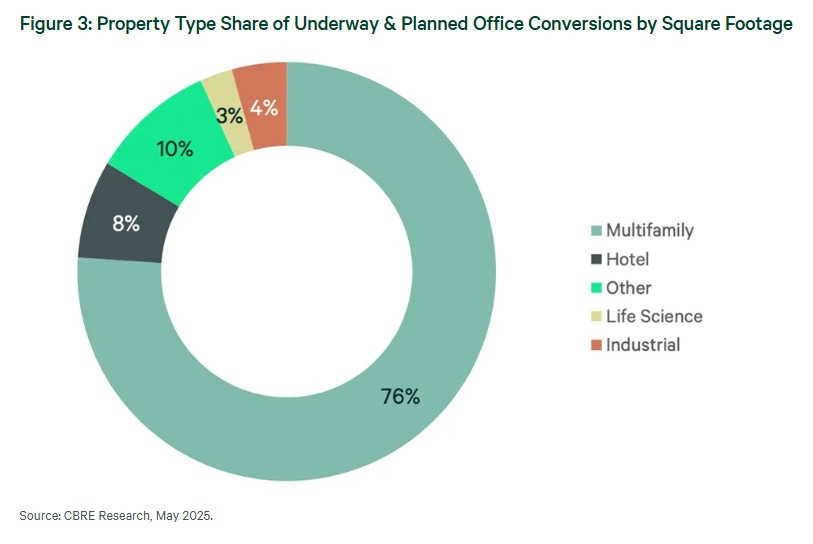

For developers, this isn’t just about demolishing square footage—it’s about repositioning obsolete assets for the next cycle of demand. Residential conversions, boutique hospitality, mixed-use reinvention—these are no longer niche strategies. They’re the core of the urban playbook.

But Here’s the Catch…

Not every building is salvageable. Many large-floorplate office buildings were designed with deep cores and limited natural light—bad bones for apartments or modern mixed-use. And the pool of viable conversion candidates is shrinking.

Add in tariffs, high construction costs, elevated interest rates, and it’s no wonder many groups are hitting pause, waiting for conditions to stabilize or for incentives to sweeten the deal. If your capital stack can’t handle unpredictability, you’re sitting on the sidelines for now.

What This Means for Investors and Developers

This shift is both challenge and opportunity. For those positioned to act, the next two years will be a prime window to:

-

Acquire underutilized office assets at a discount

-

Work with cities hungry to reactivate their downtowns—often with incentives on the table

-

Create long-term value in markets where demand for housing, retail, and experience-driven mixed-use remains high

At Kaufman Development, we’re watching this trend closely—not just as a market correction, but as a generational pivot. The built environment is being rewritten, and the winners will be those who know how to read between the lines of vacancy rates and zoning codes.

📩 Stay with us as we track this evolution—and how to invest, adapt, and lead through it.